Summary

Cannabis producers are investing in branding to avoid becoming commodity businesses. The product underlying the brand must be replicable at scale and consistent.

Agrify sells the full solution needed to grow high quality, consistent cannabis that producers can then attach to a specific brand.

By providing the end to end, seed to harvest system, Agrify has multiple recurring revenue sources and a “sticky” product that effectively locks customers into its proprietary ecosystem.

Thesis

Agrify is a fast growing, picks and shovels business that enables cannabis producers to establish differentiated brands and avoid becoming price-taking, cyclical, commodity companies. Cultivators need a cannabis product with a consistent and predictable enough user experience that it can be inexorably linked with a specific brand. Branding affords producers a vector to garner customer loyalty and command durable pricing power.

Agrify solves the consistency problem by offering a fully integrated hardware, data-driven software, and services ecosystem that allows cannabis producers to efficiently manage the entire growth-cycle of the plant. The Company’s end to end solution has several attractive attributes including a diversified recurring revenue stream, sticky product with high switching costs, and a flywheel effect grounded in its expanding data trove. Combined with capable management, lack of direct contact with the plant and the corresponding lower level of regulatory scrutiny, access to capital markets, and exposure to broader cannabis industry tailwinds, Agrify is a compelling buy.

Background and Company Description

Agrify Corporation (NASDAQ: AGFY, the Company) designs, develops, and sells integrated hardware and software for the indoor agriculture industry. The Company’s principal product is its Agrify Precision Elevated ™ system. This is comprised of vertical farming units (VFUs)- modular, smart, climate-controlled shelves for growing plants indoors- managed by a proprietary SaaS program, Agrify Insights™. In March 2021, Agrify began offering a “Total Turn-Key Solution” (TTK) where it effectively finances and leases its Precision Elevated ™ suite to customers (typically with a 10-year term) in exchange for monthly payments and a production-based revenue share. Agrify also has smaller businesses which include selling accessories (e.g. HVAC and LED equipment) and providing engineering, consulting, and construction expertise.

The Company was founded in 2016 and is headed by CEO and Chairman Raymond Chang- a successful serial entrepreneur and venture investor. Because Agrify does not directly interface with the plant, it is subsequently not prohibited from national securities markets. In January 2021 the Company went public and listed on the NASDAQ, raising $75M ($54M net) in the process.

U.S. Cannabis Producer Structure

Despite 36 states having legalized cannabis for recreational or medical use, the substance remains a Schedule I drug and is prohibited under federal law. This incongruency has left states as the principal overseers for cannabis operators. These producers, distributors, and retailers must contend with different licensing and regulatory regimes all while federal law prevents them from moving cannabis products over state lines. For obvious logistical and cost reasons, many companies remain entirely within a single state. However, some firms, known as multi-state operators (MSO), accept the bureaucratic challenge and manage businesses in various states using complex corporate structures.

Many of the larger firms are vertically integrated (either for economic reasons or because of state mandate) handling cultivation, distribution, and retail operations. Other states, most recently New Jersey and New York, have banned vertical consolidation (with exceptions) to discourage established MSOs from stifling fledging local providers.

The inability to move across state lines creates an unusual industry dynamic in that cannabis-permissive states must have the entire cannabis value chain- from cultivation to retail store sales- within their borders. MSOs cannot rely on a centralized production center, nor can single state companies transact with (out of state) geographically proximate or logistically accessible suppliers and buyers. Experience, knowledge, and IP- including brands and their reputation, are the only assets that can cross state boundaries. So long as the federal ban remains in place, operating leverage and most advantages of scale are limited to intangibles.

The current cannabis regulatory environment in the U.S. is confusing, fluid, uncertain, and ripe with exploitable inefficiencies.

Production

Approximately 53% of cannabis is produced in indoor facilities- representing a $9B TAM (per New Leaf Data Sciences)- with the remainder grown in greenhouses (inside, but naturally lit and with far less control than indoor) or outdoor farms. Indoor generally results in the best quality and most consistent product given the ability to micromanage lighting, C02 levels and air circulation, moisture, and a host of other variables. As one would expect, indoor commands the highest price at $1,737 per pound while also having the highest fixed cost, estimated at $400-500 per square foot (versus $10 for outdoor and up to $200 for greenhouse).

Indoor carries other advantages including labor-savings through increased automation (systems monitor crops and adjust input variables rather than relying on expensive, trained personnel) and indifference to weather and seasons- allowing for geographic flexibility and three to four crop cycles per year. These benefits, combined with the aforementioned superior quality, consistency, and potential for greater yields (pounds per canopy square foot), have led most commercial producers to settle on indoor facilities.

Brands, Pricing Power, and the Need for Consistency

As regulatory restraints on cannabis production are increasingly relaxed, incumbent producers risk losing pricing power and market share to the newly licensed cultivators entering the space. This supply-side flood could lead to a disastrous no-win, race to the bottom, full commoditization of cannabis. One means of mitigating this grim possibility and maintaining attractive margins is by offering branded products differentiated by a distinct quality and user experience. For a brand to endure and thrive, the underlying product must be as consistent as its label. McDonald's success is not due to the restaurant chain making the world’s best hamburgers, rather, it is largely because a Big Mac purchased in New York is the same as in Los Angeles or Chicago or Moscow. Consistency is achieved through standardized processes and procedures, conducted using hardware and software technology.

Most of the dominant business models within the cannabis space require consistency. Distributor and retail customers of non-vertically integrated producers need batch after batch of identical product in their packaging. The same goes for single state operators and MSOs. After consistency is established, branding can be addressed. The CEO of Green Thumb, a prominent MSO, goes so far as to say brand building in cannabis takes precedence over short to medium term margin concerns:

It's the early innings of the brand building game and brands (have to be) available and consistent… overall, we'll put more dollars into (branding)… we’re allocating capital where we need to be, weighing things like first mover, brand equity, competition, and differentiation…it's really about the relationship with the consumer. That can lead to the aspirational pricing power that gives a brand something. We look towards the (simplest) commodity sold products. We don't think cannabis is (simple), but water is and why (does it have) pricing power? How does that work? Pretty good rhyme for us. We’re conscious of where we are in the cycle of the decade of growth and not wanting to get too far over our skis. But we have a lot of cash, we're willing to spend… I think it's a very exciting next 3 to 5 years for brand building in cannabis, unbelievably exciting. -Ben Kovler, CEO of Green Thumb, Q3 2021 earnings call

As noted earlier, brand is one of the intangible assets that can be freely duplicated and “transported” across state lines. Though this is certainly valuable with the present federal restrictions banning interstate commerce, recognition and reputation are always crucial when expanding into new markets- even in advance of the actual product. Sonic Drive-In, a quick service drive-in restaurant franchise, built brand awareness in regions before even breaking ground on the area’s first location. Their newly completed restaurants often see strong uptake on the back of pent-up consumer demand as local customers are already familiar with the brand and its signature drive-in structure. While cannabis producers might be more limited in terms of advertising mediums (social media, word of mouth), the same principles of anticipation, brand recognition, and short time to adoption hold.

How Agrify Solves the Consistency Puzzle

Agrify capitalizes on these various realities and trends facing cannabis producers by providing the tools to grow consistent, high quality, brandable flower, at scale, in indoor facilities located within any state (irrespective of the seasonal climate) where the plant is legal. Unlike other cannabis focused, vertical farming competitors such as Urban-Gro, Hydrofarm, and Scotts Miracle-Gro, Agrify’s Precision Elevated ™ is a fully integrated hardware and software platform that spans the entire growing process all the way through harvesting and extraction. Full integration is not a hollow marketing term- it is essential for consistency by reducing the need for error-prone human labor (as well as payroll expense) and allowing data to inform optimal hardware settings that can be easily ported across VFUs and facilities. This precise and absolute oversight would be difficult if not impossible to reproduce using an amalgamation of lighting, hydration, HVAC, and software products from disparate OEMs.

Agrify’s Insights software contains Grow Plans- “templates or recipes that define the parameters for each (crop) lifecycle.” The shareability of cultivation expertise derived from controlled iteration and data analytics lessens the operational burden of expansion. CEO Raymond Chang touched upon this transferable cultivation-knowledge concept, even extending it to monetization through licensing:

The data is combed by us and our customers. So, for example, if I have a particular operator, a single-state operator that has perfected, a particular grow recipe for a particular strain, we would work with them to potentially license that grow recipe to a noncompeting operator in another state. The reason why they would be willing to do so is because it wouldn't tarnish (their) brands because they know that (if you) grow out of the VFU under the same grow recipe that you'll have the same consistent results.

The iteration factor should not be overlooked. Agrify’s self-contained ecosystem encourages perfection of a strain or blend through carefully structured experimentation. David Kessler, Agrify’s Chief Science Officer, has an interesting anecdote where he describes how a producer was able to boost a specific strain’s yield and biomass by looking at historical growth data and explicitly choosing to reduce the number of plants per rack. To compensate for fewer plants, the producer allowed the plants to grow for an additional week before harvesting. At the time, this decision was counterintuitive and was largely made based on Agrify’s analytics. Kessler summarizes the power of data-informed growing tools:

Because every individual vertical farm unit, or VFU, is independent from all the others, our operators are able to do iterative experiments and gradually but continuously and quickly improve their cultivation best practices to elicit the best results. And then they have the ability because of that data collection to repeat the exact environments time and time again.

This is what leads to and drives that level of consistency, but also the iterative process that allows our customers to increase the quality and consistency of their flower more quickly than traditional cultivators that have very few rooms to learn about how to optimize their crop.

Total Turnkey Solution: “Cultivation as a Service”

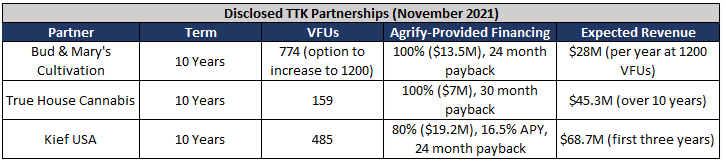

In Q1 2021, Agrify launched their Total Turnkey Solution (TTK)- a leasing program for its Precision Elevated ™ platform targeted at new producers setting up their initial operations. As of November 2021, the company has five TTK contacts and is “actively exploring” partnerships with 15 other potential customers across several states. Management has said that ~50% of resources are dedicated to the TTK program with the other half focused on the more mature MSO and traditional hardware sales business.

The material benefits of the TTK product are two-fold. The first is converting infrequent, VFU hardware sales into predictable and stable recurring cashflows, with added upside from charging production-linked fees (a quasi-revenue share). Regular cashflows can reduce perceived risk, and by extension the cost of capital (which is especially important if Agrify wants to expand its financing capacity), as well as sales and marketing expenses. Terms differ deal to deal, but the below illustrates a basic comparison (using the first TTK customer, Bud & Mary’s, located in Massachusetts) for a general sense of cash demands and flows:

The second benefit of the TTK offering is that it allows Agrify an early entry point into upstart producers. New cultivators that build their facilities around the Company’s platform become quickly entrenched in the Agrify ecosystem. Producers wishing to shift to a competitor would not only have to physically remove the VFUs and supporting hardware (even the facility itself might also require modification if it was built specifically for the Agrify technology)- a slow and potentially costly process- but also sacrifice the growing efficiencies identified and implemented by data-informed algorithms (which themselves take time to train through data accumulation).

The product’s high switching costs and stickiness enable a land-and-expand strategy that fits nicely with Agrify’s economics. While margins are not explicitly disclosed, management (unsurprisingly) indicates that hardware, predominately VFUs, is sold approximately at cost and that leasing, servicing, and Agrify Insights™ software SaaS fees are the core drivers of operating profit. Knowing this, getting VFUs online in as many facilities as possible to increase high margin servicing revenue is worth building and deploying the units at a short-term loss and negative cashflow. The VFUs were never going to be very profitable; the cost will eventually be recouped through lease payments, so the priority is to maximize the duration and size of servicing fees.

CEO Raymond Chang:

(Our) business model is not driven by short-term hardware sales, but by the future recurring SaaS and production fees resulting from our customer success… it's all about getting as many partnerships as possible, getting the VFUs out there, because we're confident that once they start using it, this is definitely going to be the default on a going-forward basis.

Immediate customer response to the TTK announcement was positive. Agrify allocated an initial $50M toward the TTK project and reports prospective client interest is “seven to eight times that level.” As of the end of Q3, nearly $10M of TTK loans receivable (loans to TTK clients) at an “approximate 20%” APY were outstanding.

“Does Not Touch the Plant”

Because Agrify only provides the tools and support needed to grow cannabis, the Company avoids the restrictions and regulatory scrutiny faced by firms that “touch the plant.” This arms-length relationship has two significant implications.

Institutional Investor Participation: Agrify is a legitimate business in the eyes of federal regulators and, unlike OTC-traded or Canadian-listed MSOs, can therefore list on the NASDAQ- allowing certain fund managers to invest in the Company. While institutional eligibility likely means Agrify has fewer exploitable pricing dislocations than OTC cannabis names (which cannot be purchased by most funds), it also entails greater liquidity and chances of the stock rerating as the underlying business grows and improves.

Ability to Tap Capital Markets: Aside from the typical hurdles of convincing investors to part with their money, the Company has no regulatory constraints in issuing debt or equity. Agrify has greater flexibility to ensure its own liquidity and provide runway for growth.

Unfettered access to capital markets can also be used by the Company’s TTK clients as a “side door” means of financing. The start-up TTK customers are frequently at the mercy of a local bank that will charge high borrow rates with restrictive covenants. Agrify takes advantage of this arbitrage opportunity by lending off its own balance sheet to finance the building of facilities and installation of the Precision Elevated ™ system. Customers gain (usually) cheaper and simpler financing (the lender is also the lessor) and Agrify captures an incremental source of income (e.g., 16.5% APY for a construction loan to TTK client Keif USA) with another sticky point of contact in the Company’s land-and-expand scheme.

Data Flywheel

Producers collect an enormous amount of data (over 1.5M data points per VFU) throughout each crop cycle that can be used by the Insights software to guide iteration and develop Grow Plans that are carefully tailored to a specific strain or desired output. The plans and data can be shared, mixed with other cultivators’ data to inform their Grow Plans, and yield a superior product. This virtuous process continues and accelerates as new customers adopt Agrify systems. Eventually, thanks to this flywheel effect, the Agrify ecosystem has a valuable and proprietary cache of cannabis growing knowledge that can be immediately (and exclusively) applied by Precision Elevated ™ users. The result is a formidable data-based moat.

Management

CEO and Chairman, Raymond Chang, has a track record of founding and successfully running small to medium sized business across several industries (broadband, automotive parts aftersales, TV shopping). Though he does not have a formal background in cannabis, he undoubtedly displays a deep understanding of the space when speaking with analysts and the press. As further evidence that Agrify stands behind the technology underlying its products, the Chief Science Officer, David Kessler- with 14 years of hydroponics and horticulture experience- has spoken on each quarterly and merger-related call since the Company went public (usually with a cultivation anecdote backed by data). Along with engaging in the company promotion expected of most executive teams, management is making a concerted effort to educate the Street and media on the demonstrable merits of Agrify’s products.

On November 10th, both the CFO, Niv Kirkov, and COO, Robert Harrison, stepped down. Far from a catastrophic exodus of talent (or signaling of business trouble to come), Kirkov will remain in an advisory role for the next few months (while this might seem like a thinly disguised coverage for a non-amicable breakup, Kirkov enthusiastically spoke as the CFO on the earnings call the following day) and Harrison remains with the firm as SVP of manufacturing operations. Both the CFO and COO roles have been filled by board members with requisite skills and professional backgrounds (private equity, corporate finance, vertical farming).

Valuation

Agrify has seen meteoric top line growth on the past two years with FY 2021 annual revenues projected to be a staggering 5x FY 2020’s. Management has not released FY 2022 estimates, but the three major TTK deals alone have an ARR of $55.4M. That said, the Company is clearly practicing its land-and-expand strategy spending $29.5M YTD through Q3 on building out customer facilities (verses $2.5M in the same period last year). Along with (currently) unprofitable sales of VFUs, ancillary products, and services, Agrify has a -1.1% gross margin. Insights SaaS revenues are de minimis as VFUs slowly come online.

This reinforces Agrify as a hypergrowth story with an explicit plan- and sufficient capital (net cash of ~$112M)- to spend to ensure product penetration and early mover advantage. The Company trades at a rich 4.5x EV/2021 sales. However, given the foundation it has built through VFU sales, facilities construction, TTK partnerships, best in class analytics and technology, as well as strong balance sheet, various recurring revenue sources, and extensive backlog, Agrify is full of very promising, but difficult to quantify optionality.

With these non-trivial considerations in mind, the below lays out a projection of next year’s (2022) revenues by bootstrapping backlog balances on a quarterly basis:

Midpoint of management’s guidance suggests Q4 2021 revenue of ~$26.4M

25% QoQ backlog growth (decreasing as growth moderates and backlog is more quickly fulfilled, rate based on historical average from all data available)

20% of the previous quarter’s ending backlog balance is realized as revenue in the following quarter (in line with historical trend, this number may even rise as production ramps and the Company is able to deploy units with less lead time)

FY 2022 revenue projected to be $163M, 167% growth YoY

Excellent upside optionality priced at 1.1x EV / 1 year forward sales

Risks

Agrify is an unprofitable, unproven small cap business that sells complex hardware and software to customers that are in deliberate violation of federal law- the countless amount of operational and regulatory risks this implies should be apparent. The following discusses more specific threats and weaknesses.

Related party transactions: There are several related party deals and agreements between various combinations of management, the board, and major shareholders. Most are small and, so far, inconsequential. Two notable relationships:

The Company sources many of its LED components from Inventronics, a Chinese OEM. The founder and CTO of Inventronics, Guichao (Gary) Hua, is an Agrify board member with a ~3.5% ownership stake. Agrify claims the “strategic relationship” with Inventronics offers material benefits in the form of preferred access to suppliers. This is a tacit arrangement with no formal or binding contract between the two firms.

Agrify is a 60% owner in a joint venture (JV) with Valiant-America- an industrial (cultivation) facility building contractor. This JV accounted for 60% ($7.27M) of 2020 revenue and 26% ($27M) of the qualified sales pipeline as of the end of 2020. Both parties retain a call (Agrify) or put (Valiant) option for the 40% of Valiant outside of the JV (payable in Agrify common stock). Valiant’s construction and engineering expertise is particularly valuable for Agrify’s start up customers (especially TTK clients) who lack the internal resources and knowledge to build out growing facilities on their own.

M&A: Inorganic expansion is a core piece of Agrify’s growth strategy. The Company’s acquisitions to date have been reasonably modest (accounting accretive, small relative to current revenues, vertical integrations that are compatible with the existing business), but deals inherently carry many known and unknown risks.

Competitors: Agrify’s fully integrated platform remains unique, but the indoor vertical cannabis farming space is becoming increasingly crowded. ScottsMiracle-Gro’s Hawthorne hydroponics division represents the most salient threat given the parent company’s size ($4.9B of sales in 2021), horticulture experience, cash to invest ($288M FCF), and a powerful CEO with a keen interest in growing the Hawthorne business.

Customer concentration and operations: 79.2% of FY 2020 revenue was attributable to three customers. The Company makes a point to carefully vet both its TTK and traditional sales customers to ensure the integrity of its $117.5M backlog as well as the creditworthiness and operational competency of its TTK partners. However, unlike pure software businesses with no physical asset concerns, the failure of a large client who has not fully paid for the VFU hardware or otherwise rents it (via TTK) could result in a considerable retrieval, refurbishment, and resale expense for Agrify.

Catalysts

MSO Contract: Agrify has several ongoing small scale (10-20 VFU) trials with MSOs and claims to be in “advanced” discussions with nearly 20 cultivators (many of which likely took place at the industry’s largest conference, MJBizCon, in late October). In July, the Company edged closer to its first MSO onboarding by inking a three-year R&D partnership with prominent producer Curaleaf Holdings (OTC: CURLF).

Existing TTK deals coming online and beginning to cashflow, additional TTK partnerships

Integration of acquired companies and future, accretive M&A: the Company recently acquired and began integrating, three separate firms (accretive to 2022 EBITDA) to build out its extraction capabilities. M&A is expected to continue as integral part of Agrify’s growth strategy.

Further state cannabis legalization and producer licensures