Blade: Much More than Instagram-Friendly Flights to JFK

Blade is uniquely positioned to benefit from the increasingly likely shift to eVTOL transportation

Recommendation

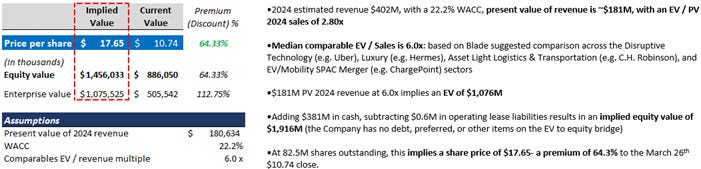

Blade Urban Air Mobility is a buy with a fair value of $17.65 per share- a 64.3% premium to its March 26th close of $10.74. Blade is currently undervalued as the market has failed to properly price the growth potential of its current helicopter focused business, synergies from the EIC merger, and the company’s unique position to capitalize on the emergence of eVTOL technologies.

Overview

Blade Urban Air Mobility (Blade, the Company) is an air transportation company that brokers helicopter and chartered fixed wing flight services. Blade is an asset light business that offers booking and manifest software, customer service, marketing, and exclusive fixed base operation (FBO) terminals. The Company contracts with “operator partners” which provide Blade-branded hardware, pilots, maintenance, fuel, hanger space, and insurance coverage for a predetermined hourly rate. Blade’s current routes are primarily located in the Northeastern United States (particularly Manhattan heliports to local airports), with some service in parts of Florida, popular Rocky Mountain ski areas, California, and internationally in Mumbai, India. The Company recently began medical transportation of human organs under its MediMobility brand and ultimately hopes to expand into electric vertical take-off and landing (eVTOL) aircraft as they become available.

In December 2020, Blade became publicly traded through a reverse merger with Experience Investment Corp (EIC, NASDAQ: EXPC)- a SPAC sponsored by travel and leisure private equity firm KSL Capital Partners.

Investment Thesis

Blade is a two-stage growth company. The first stage is growth in its traditional rotary and fixed wing aircraft services, and the second, with a target date of 2025, is a transition of existing routes to eVTOL aircraft.

First Stage: Investors today are buying a fast growing (pre-COVID YoY rev. chg. 127%), highly recognized and regarded, well capitalized ($381M cash post-merger), increasingly geographically and service diversified (airport, short distance, MediMobility), asset-light, technology-forefront business with an FBO presence in several desirable urban real estate locations.

Second Stage: Investors will also have a flexible “index play” on eVTOL introduction. Blade does not develop or maintain hardware, has no stake in the highly competitive, fragmented, nascent eVTOL space, and, as a service provider, can benefit from whichever technology becomes dominant without being forced to choose a “winner” today. Investors will have a lower risk opportunity to participate in the enormous upside potential as eVTOL makes air travel cheaper and more accessible.

Catalysts & Why Now

EIC Merger: As a result of the SPAC merger and and adjacent PIPE financing, Blade now has ~$381M of unrestricted cash on hand to pursue up to $300M in currently identified opportunities such as Northeast and West Coast infrastructure purchases, route expansion, and competitor acquisitions.

Ross Aviation FBO Synergies: Ross Aviation is a portfolio company of KSL Capital. KSL has strong operational expertise, with a 30 year track record of successful investments including the JW Marriott Essex House New York and Orion Expedition Cruises. Ross operates 15 FBO’s with the majority located in the target markets of southern California and the Northeast. In January, Blade and Ross announced plans to launch a commuter service from Westchester (including constructing a separate vertiport) and Connecticut to New York City. Further agreements are in place to expand Blade offerings at Ross’ California and Massachusetts FBOs. Blade’s growing real estate presence in high income, high potential demand markets represents an attractive value-add, network effect to consumers and a serious barrier to entry to would be competitors.

MediMobility: Blade launched the MediMobility organ transportation service in Q4 2019. During the COVID-19 government mandated lockdowns, MediMobility’s largely inelastic offering partially offset the reduced revenue in the core short distance and airport shuttle segments. Beyond diversification benefits, organ transport demand is expected to grow as demographic trends and medical technology make transplants an even more common practice.

In February, Blade entered an alliance with Vertiport Chicago with plans to offer flights from the downtown area to O’Hare Airport and surrounding locations. The Company also viewed the deal as an opportunity to expand MediMoblity offerings to local hospitals.

eVTOL Investment: Several leading eVTOL companies, such as Joby Aviation and Archer, recently underwent SPAC mergers, with a handful of other SPACs looking to make similar acquisitions (notably Dennis Muilenburg’s, former Boeing CEO, New Vista). Not only does this show knowledgeable-investor confidence in the budding eVTOL industry, but it also provides these pre-revenue, capital intensive companies with cash runway and the ability to tap public markets in the future. Several of these companies aim to have certified and flying products by 2024- in line with Blade’s goal of introducing eVTOL service in 2025.

COVID-19 Structural Changes: The full impact and staying power of trends observed during the COVID-19 crisis are still uncertain. However, developments such as a dispersed, remote, mobile, and “nomadic” workforce, coupled with population growth in suburban areas, may provide a tailwind for point to point eVTOL service. Blade also experienced reduced seasonality (demand has historically peaked in Q3 and Q4 with holiday travel) as remote work added flexibility to customers’ schedules.

Valuation

Although Blade has provided revenue projections through 2026, much of the expected growth is contingent on a successful rollout of eVTOL technologies in 2025. To minimize speculation, 2024 figures will be used.

Risk Factors

Blade is unprofitable on an operating, EBITDA, and cashflow basis. Achieving profitability, while possible, will require several years and likely additional capital infusions. Cash burn projections have not been explicitly disclosed. Route expansion and marketing spend will continue to weigh on earnings.

However, given KSL’s backing, no debt outstanding, cash on hand, and current, favorable capital market conditions, the Company has ample capability to raise funds

The urban and short distance air travel market is increasingly crowded with competitors ranging from transportation aggregators (e.g. Uber, Lyft) to legacy airlines (e.g. United’s investment in eVTOL start up Joby Aviation) to other shared aviation services (e.g. NetJets, Wheels Up). FBO exclusivity may not extend to Blade’s non-core markets (i.e. outside of New York City) and lease terms may become unfavorable.

Blade retains barriers to entry in its recognizable brand, booking technology, and FBO presence in high value markets (New York City), with potential synergies with Ross Aviation.

eVTOL is an unproven and speculative technology. eVTOL faces significant technical and regulatory hurdles. Blade’s ability to scale beyond a niche helicopter transportation service largely hinges on the success of cheaper, lower maintenance eVTOL aircraft.

With the proliferation of electrical vehicles (EV), battery production, drone development, and the capital flowing into the eVTOL space (e.g. Archer and Joby Aviation SPAC mergers) 2025 appears a realistic, though ambitious, launch date.