Summary

Blue Apron has been erroneously written off as a dying business despite an experienced, capable management team executing on a bold turnaround plan

A recent equity raise lead by a strategic investor has provided a well-timed cash runway

Corporate governance has been overhauled for the better with the consolidation of a dual class share system and the end of a family-run board

Thesis

Blue Apron common stock is a low-priced call option on a well-underway and accelerating operational turnaround. The exit of a past-his-due founder and extinguishment of his super voting stock, alongside an ambitious equity infusion from a financially and strategically significant investor, has provided the strong management team with the leeway and cash resources to pursue its long-planned growth initiatives. Further, valuable proprietary assets afford partial downside protection and successful peers serve as proof of the meal kit business model viability. Together, these factors make Blue Apron an attractive, speculative investment that could see a multiplicative return over the medium term.

Description and Background

Blue Apron (NYSE: APRN, “the Company”) is a direct-to-consumer (DTC) meal kit service. The Company sells specially packaged and measured ingredients tailored to a specific recipe that customers cook at home, usually in less than 35 minutes. Nearly all its 336,000 customers are on a subscription plan whereby they choose from a variety of menu options, serving quantities (portions for two or four people), and add-ons (e.g., desserts) on a weekly basis. Blue Apron also has smaller businesses with a DTC wine distribution arm licensed in 31 states and D.C., along with a “Market” segment that sells pantry items and cookware. The Company espouses Environmental, Social, and Governance (ESG) values as seen in its Q1 2022 carbon neutrality goal, $18 per hour starting wage, and 50% board membership diversity target.

After a rocky 2017 IPO (in no small part due to the unlucky concurrent announcement of Amazon’s takeover of Whole Foods), Blue Apron has since lost more than 95% of its value thanks to a laundry list of issues including excessive promotional spend, inefficient logistics, overly complicated recipes, customer churn, incompetent management under at-the-time CEO Brad Dickerson (previously the CFO at Under Armour during its channel stuffing scandal), and the bursting of the meal kit “fad” bubble. Sell side coverage has all but disappeared with 11 analysts dialing in for the Q4 2018 earnings call and only one on the Q4 2021 call. In April 2019, Linda Kozlowski- the former COO of Etsy and Evernote- replaced Dickerson as CEO to lead an aggressive turnaround.

New Management and Turnaround

Kozlowski wasted little time in making significant changes. She reshuffled the c-suite: hiring the former head of United Airlines catering as COO and bringing in a CFO with experience at private equity-owned (i.e., financially disciplined) retailer Ann Inc.

Kozlowski also implemented a three “pronged” strategic revitalization plan:

1. Focus on higher value customers

To reduce churn, maximize promotional and marketing spend, and increase propensity for ingredient or quantity upgrades, the Company is targeting what it labels “quality” customers. These customers tend to be higher earning ($70,000+ in household income as of 2019) and more willing to pay up for quality products. Blue Apron has also identified and begun marketing to sub cohorts such as singles and empty nesters that the Company sees as underpenetrated and likely amenable to a meal kit product.

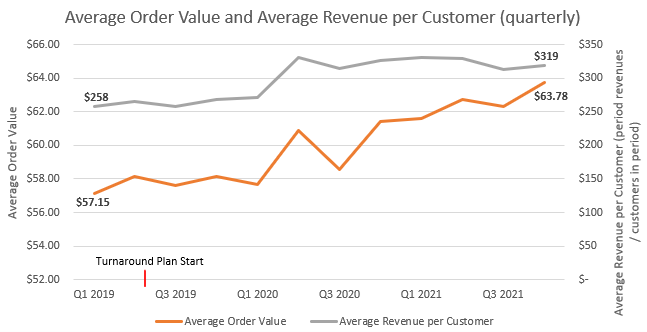

So far, the strategy appears to be working as intended. Overall customer counts and total orders have dropped, but those that remain spend an average of 8.4% more (average order value, AOV) than pre-COVID 2019, order more frequently, and are spending 23.1% more than only two years ago. The net result is a growth in company-wide top line despite the absolute customer count loss.

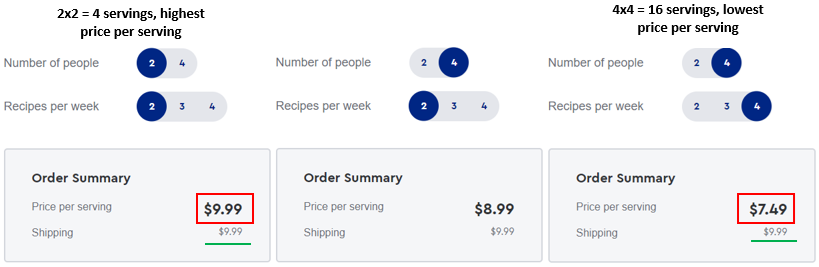

Though management seems sanguine about last mile delivery (logistics costs are more problematic in the first and middle miles), a higher AOV cuts down on total shipping costs as more value is transported in the same container. The Company has structured its pricing to encourage higher AOV through per serving quantity breakpoints and flat rate shipping:

2. Expand menu choice and flexibility

Prior to Kozlowski, Blue Apron’s menu largely consisted of a limited set of non-customizable, time intensive recipes that were impractical for a basic weeknight meal. The product was reworked with swappable ingredients, premium upgrades (e.g. a different protein), and a shorter expected preparation time. The Company has also launched ready-to-eat “Heat & Eat” prepackaged meals and even has a select menu that does not require a subscription.

Kozlowski:

“To give you a sense of how far we've come, back in 2019, we offered just 17 weekly menu options, and now we have over 50, without counting the additional non-subscription boxes on the Blue Apron market. Moreover, many of our menu options in 2019 were complicated and took too long to prepare. Now, the majority of our 2-serving and 4-serving recipes are designed to be ready in 35 minutes or less. We also introduced options that have quicker prep and easier cleanup, alongside our popular Wellness recipes.” -Q4 2021 earnings call

Previous CFO, Tim Bensley, on driving AOV through choices and add-ons:

“The idea (swapping) to a higher-value protein is interesting, but (so is) just putting more protein in the box. I have a teenager that's on one of the family plans and they need two pieces of chicken. So, I want to upgrade and put an extra piece in. A lot of the things that we're talking about doing in terms of moving forward with our (menu) capability is around getting that average order value (AOV) up.” -September 2019 Goldman Sachs Global Retailing Conference

While AOV improvement and the increase in orders per customer ostensibly both indicate positive customer reception, they must be weighed against the fall in absolute numbers of customers, suggesting that those remaining could be predisposed to buying more expensive kits more frequently. Effects of the menu restructuring on customer behavior should be carefully watched going forward, especially if management highlights Heat & Eat or non-subscription sales.

3. Scalable marketing infrastructure

As of Q4 2021, management believes the first two prongs have been largely addressed and focus has shifted toward growth through marketing spend. Marketing infrastructure includes building a first party customer data repository to prepare for a privacy-induced “Cookieless Future”, better targeted advertisements, smart couponing (e.g., incentivizing new customers, but throttling spend on those that the data now show to be less price-sensitive as they are already in the “sticky” Blue Apron ecosystem), digital content, and affiliate partnerships. Marketing expense grew 68% YoY in Q4, and nearly 50% in 2021 versus 2019 figures. Importantly, Kozlowski’s background again inspires confidence with her relevant experience as director of global marketing and customer success at Alibaba.

Initial results are promising with new registrants and reactivated accounts growing 10% YoY in the first five weeks of 2022. This is another near-term metric to monitor as management views it as key to growing YoY revenue as soon as Q2 2022.

Joe Sanberg and RJB Partners Led Equity Raise

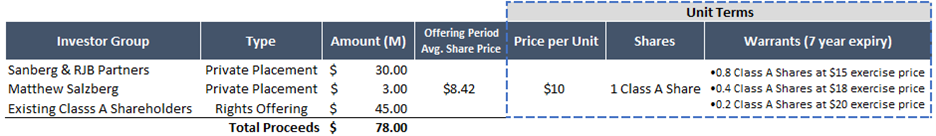

In mid-September 2021, Joe Sanberg- an early Blue Apron investor and co-founder of ESG-forward online banking and consumer finance service Aspiration- fully backstopped a $75M rights offering through his investment vehicle, RJB Partners LLC. Blue Apron’s founder, former CEO, and chairman at the time, Matt Salzberg, also participated with a $3M investment.

Existing shareholder uptake was lackluster with only $12.3M (of $45M allocated) raised. However, Sanberg & RJB made good on their commitment and plugged the $32.7M shortfall, contributing a total of $62.7M. In February 2022, Sanberg publicly reaffirmed his confidence in the Company by adding a further $5M at an even higher price of $14 per unit. The bulk of these funds will go toward the growth marketing programs outlined above.

The raise entailed several sorely needed corporate governance changes. The super voting Class B stock (10 votes per share) was fully retired and exchanged for single-vote Class A shares- terminating the Company’s unpopular dual class structure. The pseudo-family run business dynamic ended as Salzberg stepped down as chairman and his father, Barry Salzberg, also left the board. The Salzberg’s are removed from Blue Apron’s decision chain, but, between Matt and his family trust, still own approximately 14.1% of the outstanding shares.

Sanberg and two entities he controls collectively own 21.3% of the Company. Assuming no further dilution, all outstanding warrants are in the money (requiring a share price greater than $20), and are all exercised, Sanberg would have effective ownership of approximately 33.9% of Blue Apron.

Conditions of the raise included various ESG goals that the Company was already well on the way to reaching. While Sanberg does not (yet) control any board seats, Blue Apron adopted a proxy access provision. Other favorable terms of the private placement involve proposed amendments (to be discussed at the pending annual meeting) allowing those with 25% voting power (just above Sanberg’s 21%) to call special meetings of shareholders. The terms also eliminate the presently required two thirds voting threshold necessary for both director removals and Charter amendments.

This is all to illustrate that Sanberg- by all accounts a serious, savvy investor with a notable ESG tilt- has made a material financial and reputational commitment to Blue Apron, with the likelihood of eventually determining the Company’s governance slate. Blue Apron stands to benefit from Sanberg’s business relationships- in particular his Aspiration ties- as the Company searches for appropriate channel and marketing partners. Blue Apron’s genuine ESG foundations would likely resonate with Aspiration’s customers, who may already be subscribed to a meal kit service. The Blue Apron-Aspiration co-branded credit card is an early, visible example of a budding partnership. Though unquantifiable and certainly not central to the thesis, Sanberg also has political connections and ambitions that may one day prove advantageous to the Company.

Downside Mitigation

To be sure, Blue Apron continuing as a going concern depends on the success of management’s return to growth strategy and possible additional (equity) capital raises. The following partial downside mitigation elements are a stretch, but they could bolster shareholder conviction in the turnaround story- having material impacts by limiting large stock sells offs (making capital raises less expensive) and giving management more time to implement the plan.

In 2020 the Company consolidated its fulfillment operations into two warehouses: one in Linden, NJ and a smaller center in Richmond, CA. Though both are leased, the properties were originally constructed to Blue Apron’s specifications under built-to-suit terms and have been recently upgraded with equipment from the now-shuttered Arlington, TX location. While not directly sellable or mortgageable, the Company’s continued operation (and rent payments) in such specialized facilities is important to the landlords who may have difficulty finding substitute tenants.

Similarly, creditors- who are usually less than thrilled to have to manage a struggling business or go through an unforeseen bankruptcy process- could see more value in not forcing a default and ensuring the Company continues (in the short term) as a going concern. Other assets (perhaps valuable to a strategic) that would be difficult for a financial player to monetize include customer lists and associated proprietary data, as well as the DTC state wine licenses.

Ultimately, none of these items will guarantee equity receives any compensation in a worst-case scenario. However, the Company’s lack of owned and easily liquidated assets can deter attempts to sell the company for parts. Ascribing no worth to customer data, wine licenses, IP, or (quickly perishable) inventory, Blue Apron has a plausible residual value of $76.8M.

Meal Kit Business Proof of Concept

Investor enthusiasm for meal kit businesses peaked in the early and mid-2010’s as the “everything as a service” mania set in. Since then, sentiment soured, VC dollars crucial to promotional marketing (read: free meals) dried up, and many companies in the first meal kit wave folded. Investors burned by the industry’s lack of profitability proclaimed the meal kit model fraught with insurmountable challenges: the operational complexity of delivering dozens of refrigerated ingredients to customers was too great, customer churn too high, and the realistic total addressable market (TAM) of casual home cooking too small.

While the meal kit space might never be a business as enviable as Visa or AWS, dismissing the model as inherently broken is incorrect. Germany-based peer HelloFresh grew active global customers nearly 37% in 2021 to 7.22M (3.52M of those are in the U.S.), boosted revenue 60%, and is cashflow positive despite (growth) capex tripling. HelloFresh has proven the meal kit business can work and be reasonably profitable- provided operational and logistical matters are managed intelligently, the product is suited to customer needs, and churn is reduced through prudent promotional and marketing activities.

Valuation

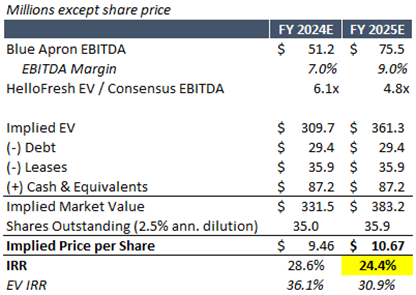

As mentioned earlier, Blue Apron common stock represents a call option on the business’ turnaround. Valuing an unprofitable company with negative cashflows and a going concern status that hinges on management successfully executing a restructuring plan falls mostly in the qualitative realm. That said, the following are conservative estimates that ignore possible step changes in valuation resulting from operational (leverage) improvements, securing a lucrative partnership or even B2B distribution channel, or outside investment from a strategic or financial interest (e.g., grocery store chain, big box retailer, food producer, ESG fund, etc.).

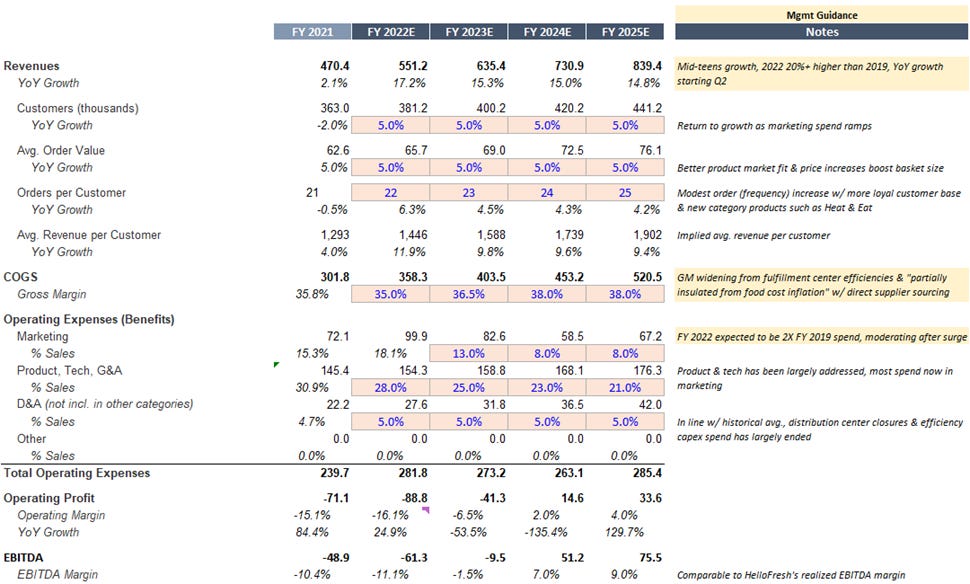

FY 2025 projections:

Annualized revenue growth of 15%, built up from:

5% annual customer growth (average 363,000 in FY 2021 to 441,100 in FY 2025)

5% AOV annual growth ($62.60 in FY 2021 to $76.10 in FY 2025)

Annual orders per customer increasing by one per year (21 in FY 2021 to 25 in FY 2025)

Gross margins increasing from 35% to 38% on the back of increased operational efficiency from fulfillment center improvements and direct relationships with food suppliers tempering ingredient cost inflation

Marketing spend spiking in the short term (per management’s customer acquisition plan), moderating over time

Other operational costs (product, technology, SG&A) falling as a percent of sales as operational leverage is realized

Depreciation and amortization in line with historical average of 5% of sales

FY 2025 EBITDA margin of 9%, comparable to HelloFresh

EV components (debt, leases, cash & equivalents) held constant (checked with implied EV IRR)

Annual dilution of 2.5% of shares outstanding

Current share price of $4.45 (March 15th, 2022)

See appendix for further details

Risks

Term loan: Blue Apron has approximately $29.4M outstanding on term loan that will have to be refinanced in Q1 2023. Refinancing is not expected to be a problem (especially if the Company is demonstrating financial progress), but the debt will cost the Company $6.2M this year in (cash) principal and interest. The note carries the added sweetener of warrants struck at $0.01 issued quarterly in an amount equal to 0.5% of all Class A shares outstanding, implying an annual dilution of 2.02%.

The loan also includes covenants specifying a minimum liquidity level of $20M in non-restricted, qualified cash (an amount the Company breached in March 2021, requiring a waiver to avoid default) and a minimum subscriber count of 320K (the Q4 2021 actual subscriber count was 336K).

Cash demands and tight maintenance covenants could limit management’s flexibility and shorten the available time horizon to implement the turnaround plan.

See appendix for further details

Additional dilution: the Company’s negative historical and projected cashflows suggest it will have to raise external financing- likely in the form of common equity as the business lacks the flows to support a sizable debt balance. Investors must trust that management will remain disciplined in any issuance and avoid excess dilution.

Sanberg control: Sanberg is an important source of funding and is currently aligned with management and Blue Apron’s broader success. However, his outsized influence has the potential to negatively impact other minority shareholders through mechanisms such as handpicked board appointees or overly generous private placement terms. This is not an indictment of Sanberg’s character, but rather calling attention to the perils of any powerful external interest.

Inflation and cost pressures: an increase in labor and food costs is expected to have a negative short-term effect on gross margins and constitute a considerable threat to the Company’s profitability if sustained. Blue Apron claims that 80% of its ingredients are sourced directly from producers (e.g., farmers), partially insulating the business from price hikes. As part of the ESG mission, starting wages are $18 per hour and include employee benefits. Together, these indicate that the Company is well positioned to navigate an inflationary environment through capping input good costs as well as not facing an immediate need to raise its already competitive wages or reduce (expensive) employee churn.

Competition: the meal kit space itself is crowded and competes with traditional groceries, delivery, and restaurants (“Food Away from Home”). Blue Apron was one of the first movers in the meal kit industry and retains strong brand recognition. Establishing a true “moat” is unlikely and management has wisely decided that operational excellence and shrewd customer acquisition is the key to capturing and maintaining market share.

Privacy measures limiting custom acquisition: a non-trivial portion of the expansionary marketing strategy relies upon leveraging personal data to identify and incentivize potential customers. While management is aware of and preparing for the “Cookieless Future”, events such as Apple making Identifier for Advertisers (IDFA) an opt-in toggle could lower marketing effectiveness and drastically increase customer acquisition costs.

Catalysts

Given the cash burn and limited runway afforded by the balance sheet, operational improvements must drive positive financial outcomes in the short term (four to six quarters) if the Company is to continue without seeking external, likely onerous, funding.

KPI improvements on turnaround plan: increase in AOV, number of orders per customer, growth in absolute number of customers, disclosure of additional telling metrics such as churn, sales by product line, or lifetime value to customer acquisition cost (LTV to CAC)

Strategic partnership announcements

Sanberg-driven changes to board composition: do any of the new appointees represent partnership or other upside opportunities?

Appendix

Valuation basis

Term loan estimated payment schedule