$1,000 invested in Peabody Energy Corporation (NYSE: BTU) stock this past November would be worth over $20,000 today- or about 10% of a JPEG of a digital rock. Despite this incredible rise and the company’s $4.45B of real, tangible, cash-producing assets, I have more faith in the long-term value of the pretend rock.

Someone paid $1.7M for the above image that I carelessly pasted into this article

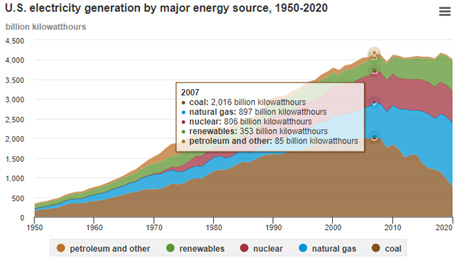

Peabody Energy is a coal miner. They make money by discovering, extracting, and selling coal (a real rock). This has been a decent business for the past century or so as the United States’ electricity demands- and coal power usage- have soared. However, for a variety of environmental, economic, and social reasons, coal production and consumption peaked around 2007 and have since been on an irreversible decline. Coal, Peabody, and the industry surrounding the fossil fuel are on their way to structural obsolescence.

Source: EIA

This is hardly unique to coal. Plenty of other sectors and firms are legacy entities that still bring in healthy streams of cash but have decidedly finite lifespans- internal combustion engine parts manufacturers, check printers, money wiring services, 15% commission apartment brokers (God willing), etc. The popular term is a “melting ice cube (MIC).” The question for management becomes: facing eventual extinction, what is the best use of the cash currently being generated?

American Treasure, Matt Levine, likes to discuss this question of capital allocation. He mostly defends stock buybacks as the most appropriate use of cash for a MIC, while also laying out three other options: reinvest in the current business (dig more coal mines), fund capex to pivot to the successor technology (renewable energy), or let the money pile up in risk free treasury bonds and slowly draw them down overtime as the core operation’s profitability dwindles. I would like to propose a solution that is a derivative of that last suggestion, but it first requires a discussion on the role of management.

Traditionally, management’s mandate is to run the company to maximize shareholder value (the more recent “stakeholder” value concept is an entirely separate topic). Theoretically, those who run a company should do whatever is in the best economic interests of its owners. This is subject to a few restraints that one could argue are beneficial to shareholders. For example, management should not break the law or screw over customers to eke out a slightly higher incremental profit as the long-term negative consequences greatly outweigh the immediate gains. Similarly, there is inherent value in optionality which requires keeping the business as a going concern- otherwise, for most of 2020, Wells Fargo, with a price to book ratio of less than one, should have liquidated in a brilliant move that would have unlocked instantaneous shareholder returns.

So, if keeping the company intact offers intrinsic, optionality-upside value for shareholders, management must have a fiduciary duty to explore unorthodox means to prolong the life of the business. Returning now to the use of the firm’s excess cash, what if instead of putting those funds into a bank vault or negative real yield treasuries they were invested in something higher octane, with staying power that also appealed to shareholders who likely already have other conventional stock and bond holdings? No, not the rock NFT. What if a MIC traded retained earnings cash for cryptocurrency?

This is not an original or even hypothetical idea. While several firms carry bitcoin (the internet informs me that lowercase “bitcoin” refers to the currency, uppercase is the blockchain protocol) on their balance sheets, they operate in the space as miners (Marathon Digital Holdings) or crypto payment processors (Square) or are run by capricious, eccentric billionaires (Tesla). However, the largest corporate bitcoin holder, with a staggering 108,992 bitcoin ($5.45B as of the time of this writing), is Microstrategy- an enterprise analytics software firm with no business ties to the currency. The company has seen declining revenues and strong cash flows over the past decade, with dim prospects for its core business. Microstrategy is a MIC that bought crypto.

A MIC: decreasing revenue, flat operating profit (until a bitcoin impairment charge)

Microstrategy is a unique case study in that the firm went well beyond buying a few bitcoins for the balance sheet. They now have two explicitly separate strategies- bitcoin holding and software (with mention of bitcoin appearing before software in their filings). The software income has allowed the company to issue billions of debt and equity to fund purchases of the digital asset. In fact, other than print cash to buy bitcoin or support a highly leveraged capital structure, whatever Microstrategy’s pre-bitcoin business does is completely irrelevant. They are the closest proxy to a bitcoin ETF in the U.S. with the share price having a correlation of 0.9 to the crypto since the initial August 11th, 2020 purchase announcement. From a shareholder value perspective, Microstrategy’s stock price went from $123 on August 10th to a peak of $1272 on February 9th (930% gain) to its current price of $712 (475%). Not bad considering the stock had been trapped in the mid-100’s range for several years.

I want to point out that there is an adjacent technical factor at play here. In the United States, it is not currently possible to buy crypto within a mutual fund or ETF wrapper- making the asset class out of bounds for institutions that need to stay within the SEC’s regulatory universe.

Those that do have spot exposure mostly self-custody their own coins and tokens (held in wallets, on exchanges, staked or loaned out, party to multi-signature set ups, etc.). Self-custody comes with operational risks that institutions cannot or do not want to manage. For example, if a pension system’s comptroller were to lose the physical wallet (crypto can be kept on a USB drive in “cold storage” where it is unreachable by remote hackers) or forget the password, well, he might have to start digging through a literal trash pile.

Newport, Wales dump, the alleged site of a hard drive containing 7,500 BTC (~$380M)

The other means of investing in bitcoin and Ether is through a trust, with the Greyscale Bitcoin Trust (GBTC) being the most popular. These trusts are regulated and available to IRAs but come with considerable baggage in the form of high fees (2%/2.5% of AUM for bitcoin/Ether), long initial lock up periods, and a price that can swing wildly from NAV.

All of this is to say that the lack of direct crypto investment vehicles contributes to a circular phenomenon. Microstrategy’s stock rose because it owns bitcoin and the currency appreciated. Bitcoin appreciated because Microstrategy, an S&P 500 company, had put the digital asset on its balance sheet, signaling the flood gates were about to open as every CFO scrambled to do the same (or not). A complimentary theory is that Microstrategy’s share price rose in part because institutional buyers wanted bitcoin exposure and, overnight, owning a formerly ho-hum, MIC software company became the fastest and cheapest way to do so. As the stock increases, it (again, hypothetically) incentivizes other firms to hop onto the crypto train, which drives bitcoin up further, pulling up Microstrategy, and on and on.

Here is a poorly formatted, convoluted flow chart to help illustrate:

If there were a bitcoin ETF, investors would simply buy that instead of getting a distorted proxy in Microstrategy- leaving the company to trade solely on the basis of its crypto holdings (and its inconsequential software business) and not carry a premium due to it being a weird surrogate for a proper ETF or mutual fund. Of course, an ETF would likely be incredibly bullish for bitcoin and other crypto as institutional capital could then access the space. Firms considering crypto would do well to front run the launch of any ETF by owning a sizeable chunk prior. So long as bitcoin does not tank- and that is a BIG if- it seems Microstrategy wins irrespective if an ETF materializes or not.

Should Peabody Energy and other MICs follow Microstrategy’s lead, lever up, and put this highly speculative and volatile asset on its balance sheet? Maybe at some point? Microstrategy seems reasonably successful, but N=1 and it may benefit from a first mover advantage (they also have a controlling CEO/chairman who is… a lot). It depends on how confident management is in the future of their coal mining MIC business and if the cash is better spent buying “digital gold” than reinvesting in operations or paying it out as dividends. I do not personally know any coal executives, though I would assume and hope they have more faith in their industry than I do. This conviction would probably serve as a barrier to such an ostensibly absurd conclusion that the best future of the company is one in which it is a Delaware C-Corp, PO box, legal shell that does nothing but hold crypto.

1209 North Orange Street, Wilmington Delaware, legal address for over 200,000 companies