Summary

New, highly experienced management team is well underway in leading a financial and operational turnaround of a previously distressed brand

Express is expected to generate 30% of its market cap in cash in FY 2022 and have a net cash balance

Highly favorable valuation at 3.6x FY 2022 EBITDA with a three-year IRR between 27% and 44%

Thesis

For years, Express has been struggling with the structural decline of brick-and-mortar retail, absence of leadership, incoherent brand image, and a product line up that failed to resonate with the Company’s target customers. However, beginning in mid-2019 with Macy’s-veteran Tim Baxter assuming the CEO role, Express began a corporate restructuring that sought to better align the business with the modern consumer. The turmoil around COVID-19 has obfuscated Express’ significant progress in its strategic redesign and return to financial health. The core business improvement, imminent deleveraging, a high margin of safety thanks to a sizable short-term expected cashflow and a low multiple price, all combine to make Express a compelling deep-value buy.

Company Description and Background

Express Inc. (NYSE: EXPR, Express, “the Company”) is a lower-midrange clothing and accessories retailer that targets men (43% of sales) and women (57%) in their 20’s and 30’s. Most products are designed by the Company’s own in-house team and conform to the Express Edit style. This style framework has themes such as “Mix & Match Versatility”, “Modern Tailored”, and “Denim Everywhere.” Express operates 356 retail stores and 207 factory outlet locations across the U.S. and Puerto Rico. Many of the Company’s stores are situated in struggling class B and C malls. Over the past several years as ecommerce spend has eroded in-store sales, Express has been closing these unprofitable locations and reducing square footage (closely linked to rent) per store.

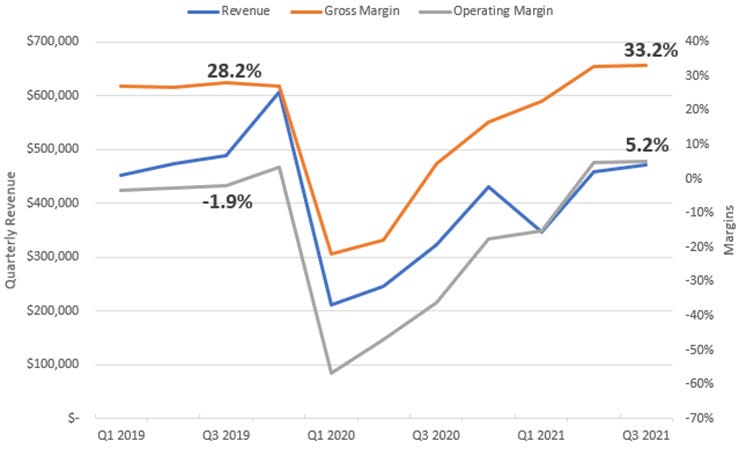

Express’ sales saw anemic growth before peaking in FY 2015 (ending January 2016) at $2.35B. Revenues and margins began declining as the Company’s product mix, marketing message, and mall-centric distribution failed to resonate with its mostly millennial customer demographic. After de facto founder and longtime CEO Michael Weiss retired in 2015 (at age 73- which may provide clues as to the firm’s disconnect with its younger customer cohort), Express went through a leadership vacuum until mid-2019 with the entry of CEO Tim Baxter. Like most retailers, the Company was hit hard by the COVID-19 lockdowns, with revenue falling 40% from 2019 and booking negative gross margins in 2020. Even as the broader business continues to navigate the pandemic chop and supply chain knots, management has been executing on an aggressive turnaround.

New Management and Business Turnaround

Within his first 60 days as CEO, Baxter appointed experienced outside talent to the chief marketing and merchandising officer positions, and soon after reshuffled sourcing, ecommerce, and operations leadership. In January 2020, Baxter implemented a new corporate strategy dubbed the “EXPRESSway Forward.” Briefly, this initiative has four basic pillars:

Product: lean into popular, established trends, such as boot-cut denim, and revamp offerings to offer a single, versatile wardrobe rather than one segmented by occasion (e.g., work outfits were separate from dressy casual).

Brand: stress versatility and build a connection with customers through a brand that “creates confidence and inspires self-expression” by “helping people get dressed every day for every occasion.”

Customer: better cater to the millennial demographic by strengthening the omnichannel sales approach. Relaunch the Express Insider loyalty program to boost retention rates.

Execution: expedite the go-to-market process and reduce risk of fashion trends changing before designed product can make it to store floors. Improve inventory management to reduce waste and increase turnover. Continue to close poorly performing stores and reduce fixed overhead costs.

While the pandemic has obviously disrupted the strategy’s original timeline, Express has seen a strong recovery from the depths of the 2020 lockdowns. The Company relaunched its Express Insider loyalty program in Q1 2021 and has so far seen 2.0M new sign ups as well as 1.8M reactivated customers. Though this program is free and hardly indicative of confirmed future sales, it does give the Company valuable customer contact information (particularly when used with the well-received Express mobile app), and the ability to notify of new products and promotions. Broadly, the loyalty program uptake demonstrates that the Express brand is becoming more front of mind in a larger swath of consumers.

“Fleet rationalization” (selective store closures) has continued with 93 closures in 2021, downsizing of existing locations when leases expire, and the opening of smaller footprint (~55% the size of conventional), non-mall Express Edit stores. The mere seven (7) existing Edit locations of course will not, in the short term, move the needle. However, the customer acquisition implications are promising with 50% of shoppers completely new to Express.

Intelligent product revisions, better distribution, cost reductions, less promotional pricing, and investments in ecommerce and omnichannel have all manifested themselves in higher margins with Q3 figures surpassing their pre-pandemic comparables.

Financial Health: Deleveraging and Free Cash

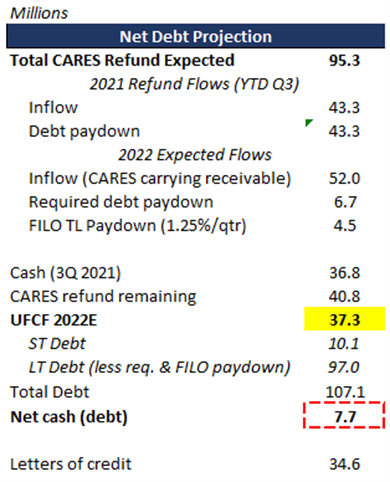

Thanks to the core business revitalization and corresponding free cash generation, combined with a forthcoming tax refund related to the CARES Act, Express will likely see a significant de-risking with a net cash position in FY 2022.

Free cash walk

Revenue: low single digit growth (management targeting ~$2.1B by FY 2024)

Gross margins: expected to widen in the short run as supply chain issues ease (see risks section) with durable long-term expansion as sourcing and inventory processes are optimized

Operating margins: compression in the short term as Express spends to restructure and close stores (smaller physical footprint could also entail lower depreciation expense per dollar of sales), mid-single digits steady state

Change in net working capital (NWC): excluded as the Company’s operational transformation has made normalizing WC balances difficult (though management expects higher returns per unit of WC)

Unlevered free cashflow: $37.3M

Net cash position

CARES Act receivable: Express expects a total of ~$95M in (cash) tax refunds from the March 2020 CARES Act’s provisions for extended carryback of NOLs, suspension of the 80% NOL use cap, and other favorable tax treatments outlined here.

Debt paydown: The Company is required to pay down its $50M Delayed Draw Term Loan (DDTL) with CARES Act proceeds. In FY 2021, Express received $43.3M in refunds and paid down the same amount, leaving $6.7M of the DDTL outstanding (to be fully paid off in FY 2022). After accounting for the $6.7M still owed, the net CARES Act receivable is $45.3M

Q3 2021 balance sheet cash of $36.8M, CARES Act receivable of $45.3M, and expected free cash flow of $37.3M against total debt of $111.6M leaves a net cash position of $7.7M.

The effects of the product and operational initiatives have begun to positively influence Express’ current financial picture as well as long term capacity to consistently produce cash.

Valuation

While the fundamental business turnaround is showing early signs of success, downside protection is paramount for a firm this small operating in such a competitive space. Fortunately, even when factoring in $50M of capex, required debt paydown, and interest expense on the current amount of debt outstanding, Express could realize 30% of its market cap in cash in FY 2022.

The following values Express on both an EV excluding leases to EBITDA and EV including operating leases to EBITDAR (rental expense as proxied by the Company’s disclosed operating cashflows for leases):

Lease cash expenses held constant at realized $290M TTM. Normalized leases are difficult to quantify given store closures and new footprint model (e.g., non-mall locations and Express Edit), 2020 back leases that were eventually paid in 2021, and rent inflation

FY 2024E EBITDA $167.5M (middle of management forecast), EBITDAR $475.5M

Modest multiple expansion from ~3.0x to ~5.0x (peers trade around 7.0x)

Three-year IRR of 27% to 44%

Realizing 30% of the Company’s market value in cash within the next 12 months along with a 27% to 44% three-year IRR offer ample downside insurance and attractive upside potential.

Risks

Stimulus runoff & uncertain post COVID-19 world: the pandemic response had the dual effect of increasing consumers’ ability to spend via stimulus payments as well as fueling their propensity to spend on goods (e.g., clothing) as opposed to services (which were either shuttered or made undesirable by COVID). Normalized sales and earnings are subsequently hard to predict. Inflationary pressures further muddle the picture. Short term macro data is messy, conflicting, and largely unhelpful.

The underlying business improvement, low baseline, and conservative estimates all support a considerable margin of safety and lend confidence to the company outperforming its current market valuation even in downside-case scenarios.

Supply chain disruptions: Express expects $15M in additional supply chain related expenses in Q4. The Company exercised prudent inventory management by prioritizing items with limited markdown risk, selectively using airfreight to bypass congested ports, and expanding its delivery network. Although Express has already pulled forward spring 2022 orders from its suppliers, persistent supply chain issues will eventually crimp margins and hurt profitability. Flying-in tens of thousands of button-down shirts from southeast Asia is not a durable economical solution.

No dedicated CFO: Perry Pericleous, Express lifer and CFO since 2015, left the Company in November to serve as CFO of private equity-owned 99 Cents Only Stores. Matt Moellering, the longtime COO, is serving as the interim CFO while the Company is engaged in a replacement search.

While Moellering has proven himself competent filling in for various senior management gaps in the past, the lack of a full time CFO is a poor signal from a firm undergoing a financial transformation. It is unlikely a short period without a singularly committed CFO will materially disrupt Express’ financial performance. The empty seat, however, may give investors pause and delay or damper a rerating on the share price.

Lease obligations: Just over 70% of Express’ enterprise value, or $784M, is comprised of store leases. Leases do not pose the same hand-over-the-keys financial threat as debt, and such obligations are typical of a retailer, but they are important to consider as an informal part of the capital structure. Baxter stated in Q2 2021 that two thirds of outstanding leases were “actionable” over the next three years, offering Express a chance to renegotiate and/or downsize. The Company has seen recent success- as measured by customer feedback and financial metrics- in reducing footprints of existing stores as well as opening smaller Express Edit locations. Smaller square footage, fewer stores from “fleet rationalization”, and the secular shift toward ecommerce all portend lower lease expenses and obligations over time.

Where is private equity?: With Express’ low to no leverage, return to cash generation, strong management chops, and relatively small size- why has there not been any publicized interest in Express from private equity firms sitting on heaps of dry powder? Absence of (known) PE activity does not directly impact the core thesis, but it deserves consideration.

Catalysts

Q4 holiday earnings

CARES Act refund and associated deleveraging (net cash position may see the Company appear on generic screens)

Appointment of an experienced, full time CFO (Baxter was able to quickly recruit reputable chief merchandising and marketing officers)

Continued EXPRESSway Forward execution across all four pillars, operational cashflow, store closures and modernization, new digital offerings

Private equity or strategic buyer interest