GoPro (GPRO): "Untethered lenses" with SaaS Aspirations

Everyone's favorite extreme-sports sponsor that isn't Red Bull is finally looking up

Summary

GoPro is no longer a low margin, spendthrift, hardware manufacturer as it transitions into offering software and services alongside its iconic, best in class cameras.

The Company has gone through an impressive, multi-year operational and strategic turnaround, which has been accelerated by the COVID-19 pandemic.

GoPro has an excellent and recognizable brand name, but it remains to be seen if the product can appeal to the masses other than the action-sports crowd.

Thesis

Once a Wall Street Darling, GoPro has been mischaracterized and subsequently discarded as a low margin, commoditized, hardware business, with a controlling founder-CEO, competing in the standing-room-only crowded digital camera space. However, the company stands to benefit from favorable intrinsic and (more speculative) extrinsic factors. Intrinsically, GoPro is realizing the culmination of multiple years of operational efficiency improvements, a return to revenue growth, a shift toward higher take-rate DTC channels, and rapid user adoption of its lucrative software and digital services products. Extrinsically, the presence of a notable activist investor in the cap table and a strong and flexible brand that invites considerable optionality upside through potential M&A opportunities make GoPro an overlooked buy.

Company Overview and Background

GoPro (NASDAQ: GPRO, “the Company”) sells cameras, mounts, accessories, and software services targeted towards consumer customers engaged in active lifestyles. The Company tends to be associated with extreme sports as its waterproof, compact, and durable cameras are favorites among this adventurous, hard charging group. In addition to its flagship HERO9 Black (with updates approximately every fall in advance of the holiday shopping season) and MAX 360 cameras, GoPro offers a subscription service that includes camera protection, special deals, cloud storage, live streaming, and content sharing. The Company also has a mobile video editing and content management app, Quik. Access is included with a GoPro purchase, or available to any smartphone user for $9.99 per year.

Approximately 32% of the Company’s $890M FY 2020 revenue was from DTC website sales, with the remainder split between retail and distributor channels. The Americas represent 59% of sales, EMEA 25%, and Asia Pacific the other 16%.

GoPro IPOed at $24 per share in June 2014 and peaked around $94 that October. Shareholders were excited by charismatic CEO Nick Woodman’s vision of GoPro as a media and drone business all centered around the “world’s passion camera.” The Company’s value quickly plummeted after a series of expensive product recalls (including a leaky, “waterproof” HERO5 Black) and failed new business ventures (the media group, Karma drone). Q1 2017 saw a restructuring and the first of several rounds of layoffs that reduced headcount from 1,550 at the end of 2016 to 774 in Q2 2021. Since the initial downsizing, the stock has been trading around the five-to-ten-dollar range. Despite this underperformance, founder Nick Woodman still holds his CEO and chairman of the board titles- in no small part due to his control of the unlisted Class B shares that afford him 70% of the outstanding voting power, though he only has 0.5% economic ownership.

Today, GoPro’s stiffest competition comes not from rival camera producers, but from smartphone manufacturers that have been integrating increasingly higher quality cameras into their (water-resistant) handsets. The Company is also facing the challenge of appealing to a wider audience outside of their core “active lifestyle”, extreme sports enthusiast base.

Intrinsic Tailwinds

1. Streamlined Operations and Smart Capital Allocation

The three years following the IPO were characterized by a bloated workforce and poor capital discipline as the Company unsuccessfully tried to develop a media arm and drone product. Following the Q1 2017 restructuring, GoPro dropped these extraneous ventures and refocused on its foundational camera product- boosting gross margins from the low 30’s to nearly 40% (a target the Company has been aspiring to since the IPO). Although revenues remained flat, profitability greatly improved with EBITDA growing from -$331.3M in 2016 to $23.9M in 2019 (pre-pandemic). COVID-19 prompted a second round of fiscal sobriety as the Company laid off 20% of its workforce and cancelled certain office leases among other SG&A cutbacks.

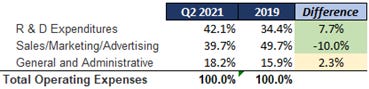

GoPro has emerged from the darkest days of the pandemic as a leaner and stronger company. Operational expenditures bottomed in Q4 2020 as the company resumed hiring. However, R&D is now a considerably larger portion of the op-ex budget- surpassing a shrinking allocation to sales and marketing. All this is to say GoPro is investing heavily in its promising, recently revamped software and services products (see below) while dedicating fewer resources to ephemeral, less transformative marketing efforts and keeping G&A roughly flat. The Company has proven capable of reining in and maintaining a judicious hand in its operational spend; and is now positioning itself for rapid digital expansion.

2. Software and Services

As part of GoPro’s push to establish a source of high margin recurring revenue, lessen seasonality (most sales are in Q4 in advance of the holiday season), and create a sticky, engaging “story telling” ecosystem, the Company has been increasingly dedicating resources to its GoPro Subscription service and its mobile app, Quik.

GoPro Subscription: For $49.99 per year, GoPro users are privy to discounted hardware and accessories, cloud storage, and the Quik app. The purchase of a HERO9 from the Company’s website includes access for year, with a default opt-out option. GoPro does not disclose the churn rate (CFO on Q2 2021 call: “they are very strong, they are very good”), but the service has seen impressive uptake with a 211% YoY growth to end Q2 2021 at 1.16M paying subscribers and a target of 1.7M users by the end of the year. Looking forward to 2022, subscription revenue is expected to increase as a percentage of total sales from 5 to 7%, or $90M, and, as one would imagine on a subscription model, EBITDA margins are substantial at 70 to 80%.

Subscription revenues are still low in absolute terms and as a percentage of overall sales, but the fast growth, ease of scalability, and attractive margins, all while locking users into the GoPro vertical make this a crucial and resilient component of the Company’s strategy to move beyond hardware.

GoPro Q2 2021 Investor Presentation

Quik App: Quik is GoPro’s iOS and Android video editing and content management application. Previously only available to GoPro owners, in March 2021, the Company opened the app to all smartphone users for a $9.99 per year subscription fee. As of the end of Q2 2021, the service has already amassed 100,000 subscribers (~$1M ARR at SaaS-like margins). GoPro’s management has made it clear this a focal point for the business as a means of generating additional, high margin revenue as well as an avenue for acquiring new hardware customers.

3. Shift to DTC Channels

Historically, over 90% of GoPro’s sales were made through retailers. Beginning in 2019, the Company began pursuing a DTC approach through its website. Unsurprisingly, COVID-19 accelerated this shift to direct ecommerce with management guiding for GoPro.com sales to comprise 40 to 45% of the FY 2021 total.

The transition to DTC affords GoPro several advantages over its previous retail-first distribution:

DTC’s gross margins are estimated to be 5 to 6% higher than retail’s

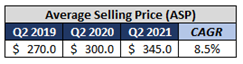

Compared to the typical retailer, the website better positions the flagship, higher margin cameras and compatible accessory products, resulting in a larger average selling price (ASP: revenue divided by count of cameras shipped) and ultimately more profit per new user.

Camera purchases through the website are currently bundled with a one year “free” membership to the GoPro Subscription service. 90% of consumers on the site choose (i.e. do not opt out of) the bundled offer- a much higher conversion rate than retail’s 7 to 15%. To be clear, it is actually cheaper to accept the subscription offer than decline (GoPro offers a “discount”, but still maintains its 40% gross margins). This encouraging uptake of the subscription platform combined with its automatic renewal structure means website sales are a direct contributor to the all-important subscription effort.

Accepting the subscription is cheaper than declining. Source: GoPro.com

4. New Products

Management understands that innovation beyond annual HERO camera updates is important to growing the business outside of its core “active lifestyle” user base. In contrast to the overly ambitious, ill-conceived media and drone initiatives, these recently announced projects require less capital outlay, are more in line with the Company’s circle of competence, and likely have superior ROI. Examples include Open API (the HERO9 Black can now interact with third party hardware and software), reboot of GoPro’s aging, but still popular, desktop video editing software, and lower-priced “derivative” cameras that allow for entry into new markets while reducing operational risk by sharing supply chains and components with the existing lineup.

None of these portend some revolutionary inflection point, rather, they indicate the company understands its limits and is expanding in ways to support its primary strengths in camera hardware and brand reputation.

Extrinsic Bonuses

These are non-critical to the central investment thesis and represent interesting optionality in the stock

1. M&A Prospects

Though its products are mostly sold to the active-lifestyle consumer, GoPro is a household name that features in high profile events such as the 2012 Felix Baumgartner world record skydive from stratosphere. The positive notoriety combined with positioning cameras as devices to share and tell stories about any topic makes GoPro an attractive and flexible brand to an acquirer. Some possible M&A avenues include:

A. Media: GoPro’s in house media venture failed, but it may attract an established player that wants to include more raw, visceral, point-of-view footage with the complimentary GoPro branding.

B. Travel: Part of GoPro’s current use case is capturing destination travel experiences. Travel companies such as Expedia Group or Booking Holdings might be able to upsell a camera with a trip plan, encourage customers to tag and upload their vacation videos, and use them as promotional material or reviews.

C. Social: Video has consumed the social media world and companies in the space have been exploring hardware products (Snap’s Spectacles, Facebook’ Oculus). A GoPro acquisition would provide one of these firms to immediately move into the physical products realm and vertically integrate from the initial video recording to editing to sharing via social media (examples: Vimeo, YouTube, Patreon).

2. Activist Investor

David Einhorn’s Greenlight Capital revealed a 2.5% stake (1.017M shares) in its Q2 2021 13F filing. The activist hedge fund has so far been quiet and not publicized any demands of management. Without speculating further, this is a dynamic to keep an eye on.

Valuation

GoPro is in the midst of a transformation as its restructuring efforts finally appear in its operational expenses and its push toward subscriptions begins making a meaningful contribution to profitability. The following lays out a projection through FY 2026 of hardware and services revenue, margins for each, and comparable firms that reflect these two businesses within the Company.

Hardware

Units shipped and ASP grow at a constant 5% annually

Gross margin differentials between DTC and retail are reflected in the ASP increase

40% gross margins, opEx as 30% of revenue, D&A at 3% of revenue (EBITDA margins flat at 13%)

Subscription

Subscriber growth declines from 30% YoY to 18% in FY 2026

Revenue is based on management’s stated $50M RRR per million subscribers

EBITDA margin growth from 70% to 80%

Discount rate of 15%

Apply one of the multiples below. Most comparables are similar hardware producers, alongside several SaaS and internet-first media platforms.

Even the bear case- treating GoPro as a low margin hardware manufacturer (8x forward EBITDA)- still produces an 80% upside.

Risks

Subscription Service Uncertainty: GoPro is still very early in their pivot toward subscription services. The Company has not disclosed churn rates and the consumer willingness to pay for a video editing and content management product is still unclear- especially given the plethora of free competitor offerings. The nascent model also has yet to indicate it can attract significant numbers of non-GoPro users and further convince them to purchase a camera.

Dual Class Voting Rights: Founder, CEO, and Chairman Nick Woodman retains 70% of the voting rights (down from 77% in 2016) with only 0.5% ownership. This entails the typical risks associated with founder-controlled companies including self-dealing and passion projects. Woodman has been criticized for the latter (media venture, drone product), but has been much more tempered and fiscally prudent since the 2017 restructuring. In a 2018 interview with Inc., Woodman conveys a sense of repentance and reform: “we used to try to hit home runs every year… (now) we would rather hit singles, doubles, and triples consistently."

Supply Chain Constraints: COVID-19 related supply chain disruptions have affected nearly every physical goods provider and GoPro is no exception. As of early August, the management still feels confident the Company has requisite inventory to meet projected holiday season demand, in part by shifting manufacturing resources toward the higher end (and more profitable) cameras. As supply chains recalibrate and backlogs clear, this risk is expected to dissipate.

Limited TAM: GoPro remains a niche product for the active lifestyle cohort. The Company touts its products as “untethered lenses” when confronted with the ubiquity of high-quality smartphone cameras. So far, this positioning has failed to have any material sway on non-action sports consumers.

Hardware Multiple: Even with the push into services, GoPro is still fundamentally a hardware business. This entails the added complexities and risks associated with developing physical goods while constraining the growth rate upper bound. With 40% gross margins and 93% of revenue coming from hardware sales, the Company has a long way to go to earn a SaaS-like valuation.

Catalysts

Significant margin improvement from cumulative operational and efficiency initiatives

Q3 results:

Subscriber counts

Gross margins (how do they compare with the 40% target?)

Supply chain constraints impacting inventories for the Q4 holiday shopping season?

Progress of Open GoPro API product

Possible activist campaign

M&A, co-branding, and/or strategic partnership announcement