Author’s note: this piece ran long. A rough summary is available here.

Summary

Maxar has become a case of two divergent businesses: the first, a satellite imaging service with a budding, capex-light SaaS model, and the second, a revitalized, improving, legacy manufacturing arm

The imminent launch of its next generation imaging constellation should alleviate capacity constraints and allow for a new phase of growth in its high margin analytics software tools

The manufacturing division is an appealing acquisition target for a strategic buyer and a sale could see cash proceeds returned to shareholders, while the remaining imaging business rerates

Thesis

Maxar has become a tale of two businesses: the first is a wide moat, high margin satellite imagery and analytics SaaS offering with strong demand across civilian government, military, and commercial sectors. The second is a rapidly improving space hardware manufacturer that has become a more resilient entity with products better suited to current customer interests. The divergence of the two businesses creates significant upside optionality in value-unlocking M&A. Despite the evolution, Maxar is still incorrectly viewed as an over-levered, capex-intensive, low growth, commoditized, data and hardware vendor fraught with operational problems1. The actual underlying business dynamics, along with capable management, deleveraging efforts, clear near-term catalysts, and reasonable downside protection make Maxar an attractive buy.

Overview and Background

Maxar Technologies Inc. (NYSE, TSX: MAXR, “the Company”) is a provider of “space solutions” to government and commercial customers. The Company is divided into two distinct, separately reporting segments:

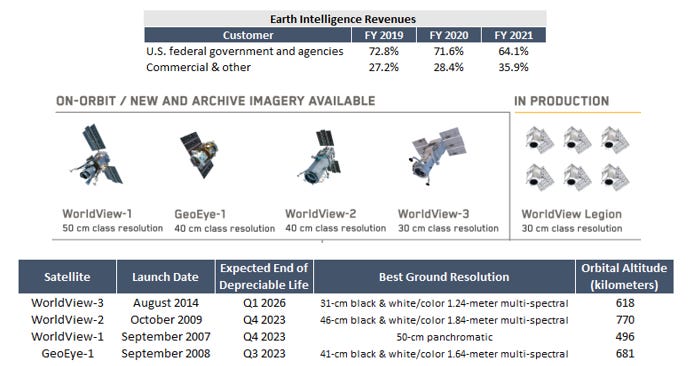

Earth Intelligence (EI), 62% revenues: high resolution satellite imagery and geospatial data captured by Maxar’s own constellation, coupled with a robust analytics suite that, among other features, uses artificial intelligence (AI) and machine learning (ML) tools to identify objects, recognize patters, and build 3D models from 2D images. Maxar is currently in the process of launching its next generation constellation, WorldView Legion (WVL). The U.S. Government, through contracts such as the EnhancedView and One World Terrain programs, is the segment’s largest customer, though 36% of sales are attributable to U.S. allies and commercial firms.

Space Infrastructure (SI), 42% revenues (before intersegment eliminations): satellite, spacecraft, robotics, and subsystem (communications, power, propulsion, etc.) design, engineering, and manufacturing. SI has historically focused on the geosynchronous equatorial orbit (GEO) communications satellite (comsat) market with its 1300-Class platform, but has belatedly begun investing in the increasingly popular low earth orbit (LEO) domain. SI also constructs the EI division’s imaging satellites. In contrast to EI, SI derives the bulk (68%) of its revenues from commercial customers such as Sirius XM, Intelsat, and EchoStar while its government contracts are almost exclusively for civilian missions (i.e., NASA projects).

Firm Wide

History

A high-level understanding of the Company’s recent history helps explain its present state and possible future paths. Maxar was formed in 2017 through the combination of MacDonald, Dettwiler and Associates Ltd. (MDA) and DigitalGlobe. MDA was a Canadian space robotics and communications provider, as well as parent of satellite manufacturer SSL. DigitalGlobe sold orbital imagery and geospatial data captured by its own satellite constellation. In early 2019, Maxar went through an internal restructuring. The Company appointed Dan Jablonsky- the former head of DigitalGlobe- as CEO, and, to better position the firm to win U.S. Government contracts, moved its legal jurisdiction from British Columbia to Delaware. Later that same year, to deleverage and further focus on the U.S., Maxar sold the (Canadian) MDA business to a consortium of financial sponsors.

Though there has been integration in the five years since the merger, to generalize, SSL makes up much of the Space Infrastructure segment while Earth Intelligence is largely comprised of legacy DigitalGlobe assets (including all active WorldView satellites).

Maxar is clearly no stranger to acquisitions, divestitures, and fluidity within its corporate structure- something that should be kept top of mind when considering viable strategic options for the company in the near and medium terms.

The First Business: Earth Intelligence

Earth Intelligence is a defensible, high margin, recurring revenue business with ample reinvestment opportunities that many mistake for a just another generic data collection and distribution service. EI is not only differentiated and enormously difficult for would-be competitors to replicate, but it also has a promising growth trajectory thanks to its new constellation and broad customer demand for its value-add analytical offerings.

Imagery is not a commodity: Maxar is the only American provider of 30cm resolution imagery- the highest currently commercially available- in which a single pixel represents a 30cm square.

Resolution2, alongside other factors such as positional accuracy (location of a pixel on the ground for mapping and targeting purposes), revisit rate frequency over monetizable areas, simultaneous imaging and downlink functionality, synopticity (capturing the entirety of the target area all at once in order to accurately observe changes in future photos of the same spot), impact the quality, caliber, and usability of imagery. Technical details are beyond the scope of this analysis, but imagery is a nuanced field that should not be treated as a simple series of interchangeable orbiting cameras.

Shots from the March 2021 Ever Given-Suez debacle illustrate the advantages of Maxar’s resolution and related technologies better than any spec sheet (credit Joe Morrison):

Satellite images of the Evergreen from space from @AirbusSpace's Pleiades, @BlackSky_Inc's Global-7, @planetlabs Doves and @Satellogic's NewSat.

Satellite images of the Evergreen from space from @AirbusSpace's Pleiades, @BlackSky_Inc's Global-7, @planetlabs Doves and @Satellogic's NewSat.

Maxar’s submission:

The 224,000-ton shipping vessel, #EverGiven, seen here in this WorldView-2 #satellite image from March 26, 2021, blocking one of the world’s busiest waterways, the #SuezCanal, since Tuesday.

The 224,000-ton shipping vessel, #EverGiven, seen here in this WorldView-2 #satellite image from March 26, 2021, blocking one of the world’s busiest waterways, the #SuezCanal, since Tuesday.

A side-by-side comparison of 1M, 70cm, and 30cm images:

Resolution quality also determines the effectiveness of analytical overlays (discussed later) applied to derive actionable insights from images:

Suffice to say that Maxar’s competitors (with the notable exception of Airbus) produce an inferior image that materially limits its usefulness.

Joe Morrison, VP of Commercial Product at imagery start up Umbra, discusses the importance of quality:

“I’ve heard people employ the phrase, “a pixel, is a pixel, is a pixel,” to color the idea of satellite-imagery-as-commodity. It sounds reasonable enough—it shouldn’t matter which company produces the pixels as long as they meet the spatial, spectral, and temporal requirements of the customer… For this type of use case (is the big ship still stuck in the tiny canal?) a pixel is a pixel, sure. But if subsequent questions come up like, “how many excavators do they have on site?” or, “Which class of tugboat are they trying to pry it loose with?” suddenly the imagery doesn’t seem so fungible.”

-A Closer Look with Joe Morrison

Morrison goes on to explain that software and processing techniques can only do so much to compensate for lower resolution photos- limiting Maxar’s competition to a handful of large aerospace and defense (A&D) firms with the resources, space craft engineering know-how, financing, and time to develop their own constellations. For context, the most recent satellite, WorldView-3, took four years from blue prints to operational at a cost of $650M. Airbus and its still-in-progress, four unit Pléiades Neo constellation is the closest and most serious Western competitor. However, Maxar, as an American company, has a decided edge in bidding for lucrative U.S. Government contract awards.WorldView Legion: Maxar’s next generation constellation, WorldView Legion (WVL), is a six-unit, 30 cm resolution fleet that promises to alleviate the long-running capacity issues EI’s been facing with its existing aging WorldView satellites. Biggs Porter, CFO, explains the issue in response to a question concerning Maxar’s Ukraine war coverage:

“We are capacity constrained and have been over key areas of interest. Even though interest is up broadly speaking, there’s only so much we can deliver. If one customer wants more than (it impacts) another (customer) as opposed to having an increase in the top line associated with the increased demand. Obviously, once Legion is launched, we get additional capacity, and we won’t be constrained, and we would have the ability to sell more minutes or deliver more service associated with imagery.”

(JP Morgan Industrials Conference, March 17th, 2022)

Initially scheduled for launch in early 2021, WVL has been plagued by constant delays- mostly related to COVID restrictions and pervasive supply chain issues (rather than internal problems at the Company). The program seems to have turned a corner with the first of three launches scheduled for the June through July period (the summer launch-window WVL units already have all necessary components installed and are going through final testing). The two subsequent blast offs are set to follow three and six months later, respectfully. Revenue generation is expected to begin in H2 2022 and ramp through 2024.Unlike the previous generation WorldView-X satellites that had unique and non-fungible designs, the Legion units are identical. The venture is also far more economical with an estimated total cost of $600M for all six units (contrast with WorldView-3 that cost $650M alone). The program itself has many fixed, non-recurring engineering, software, and infrastructure costs- leading to an appreciable degree of operating leverage whereby Maxar can produce additional Legion satellites reasonably cheaply and quickly as market conditions dictate. The Legion format also lowers concentration risk. For example, in late 2018, technical failures led to the loss of the WorldView-4 unit, cutting the constellation’s 30cm imaging capacity in half, and forcing the Company to book a $162M impairment expense (though insurance paid out $183M). If a WVL satellite were to fail, the other five (identical) units could be re-tasked to compensate for the drop in absolute imaging production (e.g., repositioned to focus on priority coverage areas). Any replacement would be faster to orbit and far less expensive than the WorldView systems of the past. With WVL’s flexibility and resilience, Maxar will have notably reduced operational risk and the ability to scale to meet demand.

Once WVL is live, Maxar will have the largest, 30 cm resolution constellation globally with seven units (until WorldView-3’s deprecation in Q1 2026 at which time the Company may commission a further two Legions) revisiting portions of the earth up to 15 times per day- making the company a leading candidate for the most stringent commercial and government customers- particularly intelligence agencies and the emerging Space Force.

“We wanted to provide synoptic (contiguous) coverage of sufficiently large areas… not everything happens at 10:30 AM, so we wanted to have the ability to image from dawn to dusk throughout the day… and most importantly—since we’re in business to be profitable, we had to do all of this for less than our previous constellation cost, i.e., we had to be even more capital efficient, as this creates the capacity to further invest in growing our business.”

-Dr. Walter Scott, CTO

Analytics and SaaS: Software tools that interpret, synthesize, and build upon raw imagery data are a fast growing, high margin, recurring revenue opportunity for Maxar. Using AI and ML techniques, the Company can highlight patterns, identify objects, and construct 3D models. The 3D application has a wide variety of use cases from fighter jet navigation to optimizing 5G deployment to autonomous vehicles to, yes, the metaverse:

“The 3D capabilities have been a real big unlock for us as the world moves from a 2D to a 3D reference model. Whether that’s a metaverse or the Army’s virtual training applications or targeting systems or GPS-denied navigation, those are all built on a 3D-type point cloud system. That’s how they work together. It snaps the world together. They’re using our data, national assets, a competitor’s data radar sets. We’re snapping the globe together on that 3D reference model.

And right now, Maxar is the only company that has a worldwide 3D reference model in high accuracy. And that’s the investments we’re making and why the customers are coming to us that propagate those types of solutions.”

-Dan Jablonsky (CEO), Barclays Industrial Select Conference, February 22nd, 2022

The investments Jablonsky mentions are organic- with $30M of spend expected in 2022- as well as acquisitive. For the latter, Maxar tends to buy stakes in other companies (often through an “imagery for equity” structure whereby the target benefits from “free” data to hone their software product) before fully assuming control. A prominent, recent example is the 2020 buyout of Vricon Inc.- the foundation of Maxar’s 3D technology- from a 50/50 joint venture with Saab.In 2021, these analytical offerings contributed $100M (~9%) of revenue to EI using only the existing constellation- demonstrating that Maxar can drive topline growth without hardware investment. The launch of WVL should accelerate the analytical SaaS segment’s development as data collection increases, the underlying AI models improve, and capacity limits are removed.

The private sector’s interest should not be ignored. Maxar counts Amazon, Uber, GM, and Palantir amongst its enterprise customers (“the who’s who of large technology companies”). Non-U.S. Government (which also includes foreign allies) share of revenues has grown from 27.2% in 2019 to 35.9% in 2021. As 3D and mapping tools become increasingly relevant to virtual and augmented reality, it is possible enterprise share moves closer to parity with the U.S. Government- de-risking via lower customer concentration and less reliance on a few key federal contracts.

Software also promises favorable margins when deployed at scale. Maxar does not breakout its EI analytics’ financials. However, using pre-acquisition Vricon as a proxy and tempering profitability to account for growth-related expenses through the income statement, 40%+ operating margins are not unreasonable.

As software becomes a larger part of the overall business, Maxar not only benefits from the SaaS structure (high margins, recurring revenue, asset light, and the re-rating that typically accompanies these traits), but also reduces firm-risk associated with hardware producers that operate over multi-year, capital intensive cycles where a single broken component can lead to months of delays and millions in forgone revenue.

Electro-Optical Commercial Layer (EOCL) award: The EOCL contract is the spiritual successor to the National Reconnaissance Office’s (NRO) EnhancedView program (the purchase of geospatial data and imagery from private sector companies). Maxar (DigitalGlobe prior to 2017) has been the beneficiary of the EnhancedView contract since 2010 to the tune of approximately $300M per year (17% total sales, 27% of EI sales). After the exercise of several extension options, the program is set to end in Q3 2023.

Unlike the current EnhancedView agreement under which Maxar is the sole provider, the proposed EOCL contract is likely to have multiple awards shared between Maxar and two newer firms, Planet Labs and BlackSky (both recent de-SPACs that had small scale “study contracts” with the NRO as early as 2019). Final terms will not be disclosed until the award is granted sometime in Q2 2022, but management seems sanguine that the $300M run rate enjoyed over the past decade can be roughly maintained due to greater absolute (U.S. Government) demand for commercial imagery3 as well as “value-added” analytical products. The following is from a Planet Labs award, but illustrates intelligence agencies’ interest in these software tools:

“NGA’s 2016 Planet subscription played a role in our analytic transformation, where we are now focused less on pixels and more on information content and services”

-David Gauthier, director of National Geospatial Agency’s (NGA) Source Commercial and Business Operations Group, October 2019

Jablonsky corroborates the importance of value-added products in the EOCL program:

“We continue to hear from our government customers the demand for geospatial data and analytics is as robust as ever. Our customers at the NRO, NGA and military services seek to leverage the capabilities of the industrial base to better understand what’s going on in every corner of the planet. Importantly, they are increasingly looking for answers to tough questions and technology solutions, not just data.

We believe the investments we’ve been making in our constellation assets, secure ground infrastructure, data platforms, 3D capabilities, AI and ML analytical tools and technology to support relevant sensor-to-shooter timelines position us well to deliver significant value to our customers… through the EOCL program.”

-Q4 2021 earnings call

EOCL is undoubtedly essential to Maxar’s business, but this is not the DigitalGlobe of the past where EnhancedView accounted for a staggering 46.5% of 2016 sales. The Company today is less concentrated. Between Maxar’s upcoming capacity increase with the WVL launch, powerful analytics suite, goodwill with the relevant government counterparties (evidenced by the EnhancedView duration and extensions), and a sense of “enough business to go around”, the Company is well situated to continue its economic relationship with the U.S. intelligence collective.Attractive economics: In 2021, EI had 65% gross and 45% (management defined) adjusted EBITDA margins. As WVL capex moderates beginning in 2023 and SaaS analytics make up a larger share of the business, margins are projected to widen, and adjusted EBITDA is expected to grow at ~10% annually (with optionality upside in the rapidly developing analytics business)- all the while free cash conversion increases. Revenues are contractually recurring- providing clarity into future flows- and have minimal counterparty risk given customers are stable governments or top-tier (tech) enterprises. With the dearth of true competition, excessive sales and marketing spend are not needed for customer acquisition, limiting operational expenses. Finally, as mentioned, upfront investments in the WVL platform make any capacity boosts or replacement units much cheaper and faster to deploy than previous WorldView systems.

Management: In addition to the CEO, Jablonsky, having an extensive imaging background, much of Maxar’s senior leadership team (including its chief technology officer, Dr. Walter Scott) is a holdover from the DigitalGlobe business. The Company also made a few notable hires in 2021- a CMO with experience in AI and electronic warfare, an EI enterprise product head previously working on video games and VR for Amazon and Electronic Arts, and Tom Whayne, a space-focused, former M&A banker who joined after serving as CFO for low earth orbit communications company OneWeb. This new talent deepens the bench within the EI division and demonstrates Maxar’s emphasis on the imaging space- particularly within analytics.

The Vricon acquisition saw its chairman Gilman Louie appointed to Maxar’s board as an independent director. Louie has a background in the defense and intelligence sector venture capital (as well as a director seat at Niantic- the creators of Pokémon Go- a relationship that could be crucial as Maxar moves into the enterprise market) that can serve as a lead generation scheme for EI’s acquisition strategy. For example, in January 2022 Maxar took a small equity position in Aurora Insight, a radio frequency analytics firm that is 35% owned by Louie. Management has indicated the firm will eventually be fully acquired. Though this is an obvious related party transaction that may warrant skepticism, Aurora has clear synergies with Maxar’s analytics suite and Louie’s credentials and success with Vricon should allay any concerns. Louie’s connections could prove invaluable in the ongoing build out of EI’s SaaS business.

The Second Business: Space Infrastructure

Space Infrastructure has struggled over the past few years due to a downturn in its core GEO comsat market, failure to keep pace with GEO-sat innovations, lack of investment in LEO technologies, and the loss of a customer satellite in early 2021. The segment is steadily being reworked with efforts starting to manifest in the improving financials.

Turnaround and restructuring: The GEO comsat market is cyclical, but 2017 and 2018 saw an unusual drawdown in orders due to operators’ fears of LEO and digital payload (i.e., “software-defined”) units bringing about the obsolescence of conventional GEO satellites4. Maxar scaled back its GEO operations, executed a sale-leaseback of its Palo Alto manufacturing facility in December 2019, and made efforts to diversify its customer base outside of commercial communications by seeking civil government and military contracts (with the long-term goal of a one third mix of each commercial, civil, and military).

Source: Gunter’s Space Page In 2020, the GEO comsat sector saw a broad revival, with Maxar (still with significant exposure to the space) winning eight major awards in 2020 through 2021. Outside of commercial communications, SI is engaged on the NASA Artemis (moon landing) program, has a few outstanding LEO contract leads (the Company has produced LEO units before, notably for imaging provider Planet Labs), is competitive in various niches including power systems, and is hopeful on winning defense customers. In May 2021, Maxar hired Chris Johnson, a two-decade veteran of Boeing’s commercial satellite division, to head SI. Johnson’s been in the role for less than a year, but his extensive industry experience should greatly benefit the business.

“We're building some of the biggest satellites in the world in the high throughput side there, propulsion, robotics and then the [T-LEO] bus design. We're finding a lot of derivatives of Legion and some other stuff we've been designing here that have gotten some good customer uptake so far.”

-Dan Jablonsky (CEO), Q4 2021 earnings call

Improved financial status: SI has managed to grow its revenue, order book, and backlog since 2019 with a book to bill ratio just under one (skewed lower as “bills” come due with the 2020 orders and older government contracts rolling off). The backlog, at $600M or ~85% of 2022’s forecasted $700M in revenue, is in line with the year-ago figure. Intersegment eliminations- stemming nearly entirely from WVL intra-company sales to the EI division- are falling as the WVL program reaches competition. This will free up SI capacity, allowing the group to broaden its customer mix and bid on external contracts. Maxar has stressed that the reworking of SI is a multi-year venture, especially in trying to become a preferred provider for defense assignments. Adjusted EBITDA margins are set to continue their expansion from ~6% in 2021, to a long-term, steady state of 10% by 2023, with modest, low to mid-single digit top line growth. SI is on its way to being a decent hardware designer and manufacturer that will at the very least no longer detract from the core imaging business and may be of interest to another party.

M&A Optionality

Maxar’s two diverging businesses, imminent reduction in synergies pending the end of the WVL construction phase, history of drastic corporate change and segment divestitures, as well as a variety of more subtle developments suggest the Company is ripe for a value-unlocking M&A event. To be clear, at the time of writing there are no credible rumors of M&A activity, and the following is based on currently available public information.

Briefly, a few conceivable M&A routes that will not be explored:

Sale of the entire firm (to a strategic or financial interest): does not solve the synergy issue.

Spinoff of the SI segment: would not have sufficient scale ($700M est. 2022 revenue) to compete against much larger A&D OEMs.

Purchase of the EI division: though possible, it lacks an obvious buyer- the enterprise customer SaaS model is an odd fit for an A&D player and defense contracting is mostly incongruent with Big Tech.

For the sake of scope and to minimize speculation, this discussion will focus on a sale of the Space Infrastructure business to a strategic buyer while Earth Intelligence remains a separate, independent company (RemainCo).

Why should Maxar sell SI?: As the development of the WVL satellites winds down in late 2022 and early 2023, the synergies between the EI and SI segments become less clear. EI progression will come from software innovations that cater to growing government and private sector needs for data analytics and 3D models. As part of any breakup, RemainCo could negotiate a deal to ensure continued access to WVL production should the constellation require added capacity or a replacement unit.

RemainCo could use the cash for organic or inorganic growth initiatives, debt paydown, or return of capital to shareholders. Free of the multiples drag from the aerospace manufacturing arm, a rerate becomes likely for the newly streamlined, asset-light, SaaS-forward company.

Why should a strategic acquire SI?: To the “right” buyer, SI can be a complementary, accretive asset given its healthy backlog, longstanding customer relationships across the government and private sectors, and strength in the GEO market with its 1300-Class bus platform. In turn, the acquirer could use its scale and resources to shore up SI’s weaknesses in digital payload and LEO technology. Provided the buyer has an established defense business and security clearances, it may be able to quickly position SI to win military and intelligence contracts. Defense work would leverage the division’s likely capacity surplus pending completion of WVL construction.

Porter (CFO) hints at existing partnerships where SI can fill gaps in other firms’ operations:

“We are seeing a lot of opportunity to partner with others in Space Infrastructure as we pursue new business. It's not solely dependent upon our own capabilities, but we bring some significant capabilities to play that others don't have. And so, the teaming opportunities seem to be going up.”

-Q4 2021 earnings call

Well capitalized, synergy-hunting, U.S. A&D firms with sizable space divisions are the most likely acquirers. An incomplete list:

o Northrop Gruman (30% space segment sales)

o Lockheed Martin (complicated by Aerojet Rocketdyne deal failure, 18% sales)

o L3Harris Technologies (28% sales)

o Raytheon Technologies (24% sales)

o Boeing (a longshot given the firm is busy battling multiple engineering scandals, space is combined with military aerospace, 43% sales)

M&A tea leaves: Again, veering cautiously into speculation territory, the following are supportive (though certainly not conclusive) of a sale of the SI division while EI remains a standalone company. Most items have already been covered.

Maxar has a history rife with acquisitions, divestitures, and other corporate actions undertaken to align the Company with its long-term goals (e.g., sale of the Canadian MDA business to focus on opportunities in the U.S.).

CEO Jablonsky comes from an imaging background at DigitalGlobe and may be interested in managing a more unified company. His recent appointment of a highly experienced Boeing executive (Chris Johnson) to run SI and hiring of an M&A banker (Tom Whayne) into a senior strategy role could indicate siloing efforts before an eventual break up.

Porter’s (CFO) comments on active Space Infrastructure partnerships.

Favorable timing: ending of WVL build out, financially improving SI segment, renewed interest in A&D given geopolitical instability (most acutely with Ukraine. Maxar’s News Bureau shows how relevant high-resolution imagery is to the media, much less well-funded intelligence services).

M&A is not guaranteed. However, the Company’s trajectory as well as current industry and geopolitical environment are conducive to a major corporate action that could result in windfall for investors.

Valuation

The following outlines base steady state and upside M&A scenarios using management disclosed adjusted EBITDA5 by segment. Supporting details and multiples are available in the appendix.

Both cases: Valued on FY 2023 estimated figures. Maxar’s long term contracts, backlog, and lead times offer the Company reasonably good insight into future flows.

Corporate expenses and intersegment eliminations (effectively zero in 2023 as WVL construction concludes) are allocated pro-rata to each segment based on contribution to adjusted EBITDA (91.5% Earth Intelligence, 8.5% Space Infrastructure).

Incremental levered free cashflow (LFCF) is for FY 2023 only and assumes the estimated $70M in FY 2022 LFCF is reinvested back into the business.

Base Case

EI: Conservative first quartile multiple, a premium to Maxar’s current firm-wide 8.9x adjusted FY 2023 EBITDA. Expansion reflects EI’s higher margin profile (45%) through its growing software and analytics business.

SI: Multiple just below first quartile’s 12.2x to account for lower margins than peers. Reflects the division’s turnaround as the GEO market recovers and SI finds success in other areas such as LEO, NASA contracts, defense, robotics, etc.

Rerate plus M&A Case

EI: Rerates to median of defense and SaaS peer group as the Company trades similarly to a software and services firm (with a nearly unassailable physical asset moat), freed of the multiple drag from a manufacturing segment.

SI: Sale based on average multiple of Northrop Gruman’s (NOC) late 2017 buyout of Orbital ATK (OA) and Lockheed Martin’s (LMT) FTC-denied 2021/2022 acquisition of Aerojet Rocketdyne (AJRD).

Deleveraging and Downside Protection

As WVL units are completed, capex returns to a maintenance level of ~$145M (down from a projected $310M in 2022), and the new constellation begins generating high margin revenue, Maxar can direct some of this flow towards deleveraging. The Company has a leverage ratio of 4.5x (3.6x net when factoring in $472M of untapped revolver capacity) and faces little risk of breaching the 7.25x covenant ceiling. Management has targeted a long-term ratio of 2-3x turns with WVL cashflows enabling material paydowns in H2 2023. These internal flows will reduce dependence on dilutive (equity) raises to manage debt loads and lower interest expense (Maxar issued $380M in common stock in Q1 2021 to repay 9.75% notes), ultimately de-risking the equity and paving the way for an eventual return of capital to shareholders.

Aside from a coherent deleveraging strategy, Maxar has downside protection in its existing contracts (e.g., EnhancedView likely running through Q3 2023), $300M of SI backlog running into 2023, $1.4B in state, federal, and non-U.S. net operating losses (many of which do not expire)6, WorldView Legion’s scalability and resilience (allowing some margin for error, particularly when compared to other idiosyncratic space hardware projects such as WorldView-4 that have zero recovery in failure outside of insurance claims), and unquantifiable, but valuable, longstanding relationships across numerous commercial, civil, and military customers

Risks

WorldView Legion launches: Getting $100M pieces of delicate hardware to orbit is quite literally rocket science and fraught with operational risk. The launch schedule has also been repeatedly pushed back. Most delays have been a function of unfortunate, extenuating circumstances (e.g., COVID worker shortages, supply chain disruption, transporting the completed satellites via truck because heavy-lift Antonov cargo aircraft have been destroyed in the Ukrainian conflict). However, persistent deferrals could erode the Company’s credibility with U.S. Government and private customers- leading those would-be buyers to consider alternate (though inferior) solutions.

Imaging competition: While Airbus’ constellation is the only salient hardware comparable to Maxar’s existing fleet and WVL, imaging startups including Planet Labs, BlackSky, and Terran Orbital have greatly increased the supply (and lowered the cost) of frequent imaging. These companies also have their own analytical services that could challenge Maxar’s emerging, SaaS-forward business model (though the hardware gap and the Company’s deep data repository offer a distinct advantage).

Leverage and refinancing: Maxar has a feasible plan to deleverage through cashflow from (WVL) operations. However, the Company still carries a large debt load going into a rising rate, less borrower-friendly environment. Debt refinancing could prove difficult or onerous, forcing Maxar to raise funds through an equity issuance, thereby diluting shareholders.

Space Infrastructure’s over reliance on GEO comsat: Failure to continue to diversify the business into more predictable, future-proof markets such as LEO or military intelligence leaves the segment exposed to GEO comsat’s cyclical fluctuations (and potential, but low-probability of obsolescence or permanently, severely depressed order volumes). The comsat dependency problem could be exacerbated as operators extend the design lives of their current constellations and postpone replacement orders.

Catalysts

WorldView Legion launch: first of three likely in early Q3 (proof of concept to the market after countless delays)

EOCL award: reduces uncertainty regarding possible (revenue) differences between this contract and the existing EnhancedView program

Continued success and growth of SaaS analytics: incremental (high margin) revenues are increasingly generated from software development rather than hardware innovations

Additional GEO comsat or LEO awards

M&A: rumors, confirmed discussions, or announced plans

Appendix

Comparables and Precedent Transactions:

Of course, one should not read (at all) into such offhand statements, but it is somewhat indicative of the old economy manufacturing lens that much of the Street uses when analyzing Maxar: (following a discussion with management on 3D SaaS products)

“(Let’s) make sure we get to talk a little bit about space infrastructure and a topic that's a little bit more mundane, but probably where I'm on firmer ground and the technology is financial statements.”

-Seth Seifman, JPM Equity Research Analyst, JP Morgan Industrials Conference, March 17th, 2022

Maxar’s CTO, Walter Scott, has a helpful overview presentation (resolution discussion starts at 2:30)

The war in Ukraine is hopefully an aberration, but U.S. intelligence imaging demand has more than doubled since the start of the conflict. WVL deployment cannot come soon enough.

Maxar’s adjusted EBITDA is a somewhat conservative figure that removes one-time events rather than unrealistically adding back recurring “non-cash” expenses (for many firms, the most egregious example is ignoring stock-based compensation), making it a reasonable proxy for cash profitability. Recently, these accounted-for unusual events, such as stripping out insurance proceeds, have reduced adjusted EBITDA relative to “standard” EBITDA (see page 62 of the 2021 10-K for the past three years’ reconciliation)

Will- I’m ok with the longform piece. Thank you for your analysis.

I like this company strategic acquisition or not. Appreciate the deep dive 👍