Montrose Environmental Group (MEG): a Roll Up Story

Assessment and Measurement and Remediation, oh my!

Thesis

Montrose Environmental Group offers a pure play opportunity to capitalize on the growing regulatory, corporate, and investor interest in measuring and limiting environmental impacts. Competent management, with experience in both deal making and operations, has allowed the Company to acquire and integrate disparate business that enable Montrose to offer a full suite of environmental services across regulatory jurisdictions. This “one stop shop” is a compelling value proposition for clients looking to simplify their environmental efforts and spend. As the Company grows organically and through M&A activity, it will further benefit from scale advantages including higher operating margins as overhead costs are shared over a wider revenue base and a lower CAC from greater brand recognition and cross selling (new) products to cheaper-to-convince, existing clients. Along with the growth story, Montrose’s diversified, stable, and COVID-19- “battle” tested revenue streams limit buyer risk and enhance downside protection.

Background

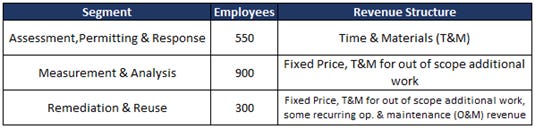

Montrose Environmental Group (NYSE: MEG, the Company) is an environmental services firm that operates across three segments:

Assessment, Permitting, and Response

Measurement and Analysis

Remediation and Reuse

Since its founding in 2012, the Company has grown primarily through an M&A roll up strategy in a bid to deepen its product offerings as well as expand its geographic footprint. Of Montrose’s 5,000 clients, 86% are private corporations or organizations, with the remainder public entities across local, municipal, state, and national levels. Because of the wide variety of clients and projects, revenue and contract terms differ.

Industry, Competitors, and Macro Factors

Environmental services- including assessment, measurement, testing, inspection, and remediation- is a highly fragmented industry with several large firms and hundreds of smaller, local players that tend to offer a single product. Importantly, many of these larger companies are engineering or construction consulting businesses that provide a limited set of environmental services that are tailored to the types of (construction) projects they serve. Few, if any, of these competitors have Montrose’s breadth- a distinct advantage for clients with needs that might go beyond remediation (clean up) into an ongoing air quality testing program.

Aside from the more obvious necessary technical qualifications and regulatory approval, entering a market can be difficult as it usually requires overcoming long standing customer relationships. Rather than fight incumbents (which can be decades-old mom and pop shops with a dozen employees) and build from the ground up, the industry has expanded and consolidated through M&A (Montrose being a leading example).

Finally, environmental services clearly exist in a favorable macro context. Additional environmental regulatory scrutiny, the proliferation of renewable energy projects (supported by Federal tax credits), demand spurred by impending infrastructure bill, investor interest in ESG, increase in frequency of climate change-linked natural disasters, and a broader realization that environmental services can actually bring economic benefit to a client (by mitigating liabilities or savings through reduced resource usage) all point to a greater need for these products in the immediate and long term futures.

Value Proposition: Simplicity as a Service

Montrose describes its clients’ demands as “broad in scope but localized in delivery.” Clients’ needs are seldom restricted to one vertical under the vast environmental services umbrella. For example, the CEO, Vijay Manthripragada, highlights the diverse set of problems (and opportunities) created by the California fires:

“So as a result of fires, for example, or the mitigation process… there's going to be a need for both data analytics, which is going to be very complementary to our recent acquisition of the SensibleIoT platform, but also testing. You can imagine the impact on air quality from some of these fires, and then, potentially, the ongoing remediation. The other part that some of our customers have started to talk to us about, though it's not immediately actionable for us right now, is a lot of these fires are put out by compounds that have PFAS (Per- and polyfluoroalkyl substances) in them. And as you know, that's an area where we're strong. And so, I would see both of those as near-term opportunities.”

-Vijay Manthripragada,CEO, Q2 2021 earnings call

These fires require (at minimum) data collection, monitoring, and analytics; air quality testing and remediation; detection and removal of PFAS substances from soil and water. Rather than hunt for several companies that (in aggregate) can address these issues, negotiate contracts with each, and coordinate scheduling and assume other administrative tasks, clients would undoubtedly prefer to deal with a single provider. In many cases, Montrose has the requisite expertise to be that one-stop shop and is continuously adding to its offerings (see M&A below). In complex or emergency situations, the ability to have a single vendor is an incredible, simplifying value-add that clients might be willing to pay a premium for.

This single point of contact dynamic can also be advantageous when only one line of service is requested (for example, soil testing), but across multiple geographies and regulatory regimes. Here, Montrose can use its scale and local operations to produce consistent and valid results in each of these jurisdictions, while saving the client from having to source individual, location-specific providers.

Growth Drivers

Montrose’s growth can be segmented into one of two categories: organic and M&A.

Organic

Management defines organic growth as change in revenues excluding those from acquisitions or disposals in the preceding 12 months. For context, organic annual growth is expected to comprise 7% to 9% of the targeted 20% plus in total revenue growth (though the organic figure is rather volatile owing to the Company’s frequent M&A activity).

Despite having a reputation as a roll up story, the Company has significant inward focus in developing existing businesses. For example, Montrose has an extensive portfolio of PFAS-decontamination related patents from previous acquisitions (MSE Group, ECT2, Vista Analytical). Rather than sit on these and milk the current technology, in 2020 the Company reorganized its R&D group to synthesize and improve on the IP. Montrose has also made more conventional investments in its CRM systems, marketing efforts, and educational publications. Management has signified it does not intend for operational spend to come at the cost of cash generation and targets a balanced 50% CFO to adjusted EBITDA conversion rate.

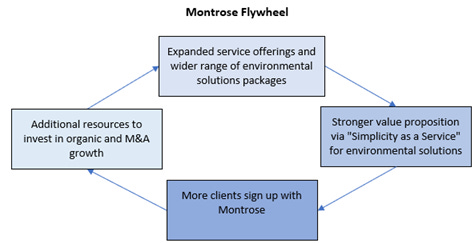

Most of the organic expansion, however, is through the integration of its different businesses from a cost perspective- sharing SG&A and other overhead expenses- and boosting revenue per customer by cross selling services. Clients may come (either from sales efforts or as part of an acquisition) to Montrose for a single project or test, the Company now has a beachhead to further commercialize the relationship by pitching other, complimentary services. This has begun to extend to “integrated solutions”- that is, providing clients with a package of services designed to accomplish a defined goal, such as wildfire prevention and remediation. Montrose recognizes the low hanging fruit in cross selling and has established an account management team to foster and deepen these larger relationships. The group has already seen some success with one client going from generating $50,000 of revenue in 2018 to $1 million in 2020 and tracking for $2 million in 2021. As Montrose as a business and brand continues to expand, the Company will attract more customers, have more services to offer and cross sell, increasing its “simplicity as a service” value proposition, and drawing further customers in a powerful flywheel.

M&A

Much of Montrose’s growth has come inorganically through over 50 separate deals since 2012. These acquisitions vary in size, geography, line of business, and strategic imperative. The Company maintains an internal M&A team with close connections to potential targets and industry brokers- frequently sourcing deals through word of mouth. Management also has considerable experience in deal making with the CEO previously working in healthcare M&A banking at Goldman Sachs, the CFO, Allan Dicks, having several senior financial roles with the latest as CFO at acquisition-oriented Convalo Health International, and other c-suite executives with backgrounds in roll-up advisory and infrastructure private equity.

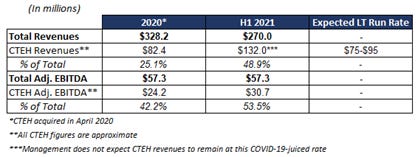

The April 2020 acquisition of emergency preparedness, response, and recovery firm, The Center for Toxicology and Environmental Health (CTEH), was by far Montrose’s largest and has so far been a major tailwind as COVID-19 has (temporarily) raised demand for the company’s services. Including contingent consideration payments, Montrose paid $243M for CTEH ($147M of which was recognized as goodwill). Approximately $175M of the purchase price was cash raised from a sale of convertible preferred to Oaktree Capital. In return, Oak secured a board seat and a 9% cash dividend. This may appear onerous but having Oaktree’s involvement and contractual quarterly cash extraction forces management capital discipline- especially when considering new acquisitions. In addition, the CTEH buyout was exceptional given its size relative to the rest of Montrose. Mergers prior and following CTEH’s have been funded through balance sheet cash or small issuances of common stock.

This is all to illustrate that Montrose and its leadership are willing and capable of executing transformative deals that expand and fortify the Company’s holistic environmental services platform.

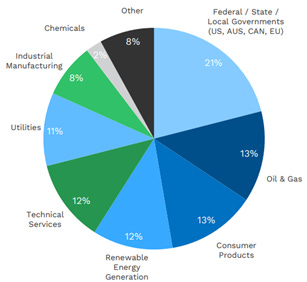

Resilient Business

Though Montrose’s size and structure will vary over time M&A activity (including possible divestitures), its clients and revenue sources are quite stable and non-cyclical. Customer revenue churn rates were less than 10% in 2019 and 2020 despite most contracts being cancellable at the client’s discretion (subject to a termination fee). Revenue is diversified across a wide client base with the largest 20 customers only accounting for 36% of 2020 sales. Montrose also incurs minimal industry concentration risk with the top sector contributing 18% to total revenue (the industry itself is not disclosed, but, based on S-1 and investor presentation data, it is mostly likely the oil and gas sector). Industry dispersion and the Company providing products for all potential stages of a project- commencement, maintenance, monitoring, decommission, remediation- do much to insulate Montrose from sector-specific and broader economic cycles.

Montrose’s clients are often mandated by regulatory authorities to make use of environmental services to meet health and safety standards. The Company’s revenue from these customers is effectively a non-discretionary expense line item that can withstand unpredictable external forces. This was evidenced during the initial COVID-19 shutdowns as Montrose’s services (and the revenue they brought in) were designated as “essential” and experienced minimal (regulatory) disruption. Regulations themselves, and the associated revenue, are mostly made at the local or community level and subsequently tend to be protected from abrupt Federal or state political regime changes.

Management likes to argue that their services can lower liabilities, make a given client’s firm more attractive to investors or business partners, and allow for cost savings through efficiency measures such as less energy or water usage. Assuming this is true, clients are not just legally obligated to spend on environmental services, but they want to as it is in their best economic interest. Hard proof of this is currently lacking (to say the least), but it represents an interesting upside if Montrose can attract new business by selling clients on a legitimate cost-reduction angle.

Valuation

It is nearly impossible to accurately project cashflows for a company that is expanding through frequent and unpredictable M&A actions. The following considers management’s guidance and observable trends within the existing yet highly fluid business. As Montrose matures and further information becomes available, a bottom-up approach based on revenues, margins, and cashflows from its three business segments may be a more prudent means of valuation.

*Valuations exclude potential upside from future accretive acquisitions*

Revenue: FY 2021 $454M (up 38% YoY), increase driven largely by CTEH acquisition/COVID-19 tailwinds, constant 20% YoY growth there after

Gross margin: tracking historical average of ~33%

Operating margin: highly variable based on business mix (e.g. some of CTEH’s COVID-19 related projects have lower margins than others within the Assessment, Permitting & Response segment)

SG&A: trending downward from ~22% to low teens as operating leverage dynamics (shared costs and administrative efforts) take effect

D&A: 10% of sales, in line with historical average

9% (and growing) operating margin by FY 2026

EBITDA: $215M by FY 2026, 19% margin

WACC: 10%

Terminal multiple

Downside case includes lower multiple construction & engineering firms (more asset intensive, higher depreciation and corresponding capex)

Base case are firms explicitly listed by Montrose management as competitors

Bull case peers are restricted to research/consulting and strictly environmental servicing companies

Montrose in its current state is not overly asset heavy. For example, its Remediation and Reuse business provides advisory and planning services, it does not own any facilities, material amounts of equipment, and most employees are highly skilled engineers and scientists (i.e., not lower wage laborers).

Risks

Expansion through M&A is inherently a high-risk strategy. Deal processes are expensive and time intensive endeavors that pull resources and management’s attention away from day-to-day operations. Once acquired, the target company must be integrated into the existing business in a series of complicated, delicate steps that span technology systems mergers to ensuring cultural fit. M&A is a leveraged growth approach- both the upside and downside are amplified- where competent and experienced management is crucial.

CTEH, while ostensibly a solid business from an execution and financial perspective, has received criticism in the past for allegedly mishandling data in ways that portrayed its corporate clients in a better light. For example, during Hurricane Katrina and the BP Deepwater Horizon oil spill, CTEH was accused by environmental watchdogs of conducting “sloppy” sample collections and making typos on reports that showed lower levels of contamination than was later proven. CTEH remains in good standing with authorities, including the EPA, and could just be the easy fodder or lightning rod of outrage for activist groups that are rightfully upset with an environmental disaster.

The CTEH story demonstrates a more fundamental risk to Montrose- the Company bears the potential for tremendous brand and public relations backlash due to its involvement in emotionally charged, politically sensitive events such as natural disasters or corporate environmental scandals. While most of Montrose’s work is routine and innocuous, association and culpability associated- whether fair or not- with a high profile, negative event could have damaging legal and reputational repercussions.

Montrose has financed many of its acquisitions through stock issuance and dilution remains a concern. The Company has capacity to use debt to fund future purchases (current leverage of 3.1x, well below the current credit facility’s cap of 4.25x) but may choose to take advantage of its rising share price and issue equity instead. Beginning in 2024, Oaktree’s $175M in preferred equity (used to finance the CTEH acquisition) is convertible into common at a 15% discount to market value- further contributing to dilution risk (though the Company has the option to repay in cash).

Catalysts

Accretive or well received M&A transaction(s)

Disaster response and prevention

Natural disasters: either a single event that materially increases revenues in the short term and/or added frequency of damaging weather events that cultivate and accelerate demand for Montrose’s services

Man-made: incidents such as oil spills that add to immediate revenues and allow the Company to showcase its capabilities and, in turn, build its brand

Infrastructure bill passage and initiatives that require substantial additional environmental services

Delta-driven demand is more enduring than initially predicted

Boost to short term revenue

Companies remain clients for a longer period, increasing probability of success in cross selling other Montrose services