The above image is taken from Amazon’s homepage on October sixth- a full 51 days before Black Friday, the traditional start of the holiday shopping season. Even the most aloof shoppers will notice the festive, vaguely winter-like tree decorations and the less subtle “Shop early” listed on the banner and plastered throughout the site. After Black Friday door buster deals peaked in the early 2010’s, retailers began stretching out the gift buying period- partially as a function of sales moving online but also to reduce strain on domestic delivery services, ensure stores can be restocked, and for less interesting corporate finance-type reasons such as pulling cash receipts forward.

But early October? This is not an overly aggressive sales move. Amazon knows something is wrong and they are trying to get ahead of it.

Of no surprise to anyone who has glanced at the news or tried to buy nearly anything in the past year, this is all in response to mangled supply chains that have been upended by bull whip effects, labor shortages, and COVID restrictions. Here are a few visuals to illustrate how absurd and dire the situation has become:

To close this painfully obvious loop between early holiday sales and disastrous supply chain conditions: retailers are concerned they will not have sufficient supply on hand to meet the expected high demand of the flush with (stimulus) cash, stock market-rich, ready to spend American consumer.

An investor could approach this supply and demand mismatch a few ways. One might be to buy and control certain points along the supply chain- warehouse space, shipping containers, vessel charters, chassis rentals, cargo planes, landing slots, etc.-, raising prices as distributors race to beat the end of December deadline. Another might be to perform deep due diligence and find companies that have less upstream exposure to global suppliers or already have requisite inventory on hand. Or perhaps it is best to avoid goods that are constrained by physical inputs and allocate toward firms that sell software or human capital-based services (haircuts, personal training sessions, Cameo videos).

However, certain consumer companies may experience an outsized tailwind from a perennially popular item that is always in near infinite supply, is available to tangible and non-tangible product sellers alike, and is arguably the greatest financing innovation since securitization: the gift card.

Gift cards are brilliant:

They are an interest free loan with little, if any, restrictions on the use of the cash

Cards are often not redeemed or are not redeemed for their full balance. Gift card accounting “breakage” rules allow sellers to, overtime, recognize unclaimed cards as revenue. In 2020, an estimated $3B was left languishing on cards. This is literally free money for sellers.

Consumers that do redeem tend to use the entirety of a card balance plus additional cash in purchases, increasing total sales. Card limits are seldom respected.

It is more socially acceptable to gift a card than the equivalent amount in cash. Those that give the cards as presents are effectively trading away fungibility (from cash to a card that has limited uses) for passable social credit.

The lazy and circumstantial investment thesis is beginning to take shape: supply chains are incapable of delivering enough physical goods to satiate cash-laden consumers. Many people have a desire and social obligation to give gifts, but also have a desire and social obligation to do better than stuff raw cash in stockings. Sellers have a strong financial incentive to promote gift cards and do not face capacity restrictions (digital gift cards exist for the neurotic few who were concerned about plastic card supply). Therefore, consumers are going to buy gift cards in mass and companies that are well positioned to take advantage of this will outperform. Even in the below chart data from 2020 when supply chains were less stressed, half of U.S. adults planned to buy a card. 2021 has similar relevant macro dynamics, only much more so.

Accepting the gift card postulate, what companies best stand to benefit? The obvious answer might be firms that normally sell a lot of cards and have significant physical inventory. This is correct, but there are some additional variables which can further refine the screen:

Maximizing breakage income (free money)

Fungibility of the card: While gift cards can only be used at a specific retailer, the variety of goods and services offered at a given retailer varies. Amazon cards are much more universal and closer to cash than those from Red Lobster. Cards that are less fungible (i.e., less useful) have a greater chance of not being spent and winding up as breakage income.

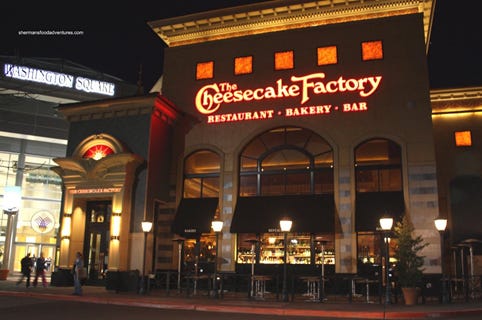

Ease of spending: The more hurdles there are to spending the card, the less likely it is the money will be spent. Online retailers, especially those that are optimized for recurring, account-based spending (Amazon, Apple App Store, Netflix) make using the card frictionless. In the case of subscription services, the spending is even automated. To minimize redemptions (raising breakage income), the ideal seller’s business would require customers to use their cards for in-person services that themselves are usually reserved for special occasions (birthday celebrations, vacations). Indulgent restaurants such as Benihana’s are more attractive than the utilitarian Chipotle.

Historically high breakage income: Any other idiosyncratic factors or historical patterns that indicate a company will recognize a disproportionate amount of gift card balances as breakage income.

Other considerations

Use for the cash: Apple is a large seller of cards but would see little ROI from additional cash considering it already has $34B sitting on its balance sheet (plus $28B in marketable securities- effectively a store of cash). A company that could use the funds for an acquisition or to paydown debt and de-risk might get a deserved bump in stock price.

Low current inventory levels: A retailer that manages to sell a lot of gift cards but has little product on hand enjoys a few advantages. The company has a longer period of float- cash in hand without having to provide the requisite good or service- that can be deployed as needed. Consumers feeling the card burning a hole in their pocket might be more prone to settling for older or otherwise previously unsellable inventory (clearing out stocks, reducing write downs). Finally, as the customer holds the card longer, they are simply more likely to forget about it, never spend it, and let it flow into beautiful breakage income.

Gap between average sale price and average card balance: As mentioned previously, consumers tend to add their own cash and spend beyond the card balance. If the typical gift card is $20 and the average sale is $100, consumers are drawn in by the possession of the card, but the bulk of the transaction is organic (new) revenue. The more “motivated over-buying” the better. This is an improvement on retailers attracting customers with temporary discounts. Rather than accept a lower sale price, the retailer is spreading the full price across two transactions involving two separate buyers.

Using these guidelines, a profile of an investable candidate begins to appear.

The target is a restaurant with a small number of locations that are situated in higher rent districts or Class A malls. Patrons do not frequently go to the restaurant, but when they do, it is usually to celebrate a notable personal event (e.g., a birthday party) with a group of people that will inevitably bring the total tab to something much larger than would be ordinarily gifted on a card. The restaurant’s corporate entity has significant operating lease liabilities and high degree of leverage from raising debt to fund past acquisitions or to offset cash burn during the COVID-19 lockdowns. While inventories are not a major concern, food-away-from-home prices have risen 4.7% through August- deterring customers who might decide to wait for stabilization or reduction (“transitory” inflation) in menu prices.

To be sure, this needs to be weighed against all other internal and external factors that influence the business and its share price. However, the pick that inspired the above story?

NASDAQ: CAKE