Semi-Serious M&A Ideas: Facebook & OpenSea

The first of a series: exploring potential acquisitions with some suspension of reality

Author’s note: this post was initially going to include several ideas but has been reduced to one in the interest of balancing analysis and length. More to come.

2021 Deal Making

2021 has been a wild year for M&A . Through the end of August, a total of $1.8 trillion of deals have been announced in the U.S. alone. Globally, that figure is $3.6 trillion. This is only expected to increase as private equity firms seek to deploy some of their nearly $1 trillion in dry powder and the 400 outstanding, aging SPACs, with a collective $120 billion sitting in trust, begin to nervously watch the clock as their (typically) two-year deadline to find and merge with a target draws closer.

It has also been a prosperous time for bankers with the bulge brackets racking up an estimated ~$6.5 billion in fees through the end of Q2. But what if it is not enough? Housing prices are at all time highs, supply chain issues continue to lead to shortages and “transitory” inflation, private school and college tuition is certainly not decreasing, and, worst of all, yacht charters are demanding the full rate on their rentals. So, for those who are feeling the tightening golden handcuffs and need to close another deal before bonus season, here is the first of a handful of half-baked ideas that might be worth having a (now better paid!) analyst flesh out.

It is a brutal market out there

Facebook buying OpenSea.io

Facebook recently announced its ultimate goal to be a pioneer and major operator in the metaverse. The metaverse is a vague term for a shared, virtual world in which people interact, transact, work, and, in many respects, live. Beyond continuously rolling out features to keep its 2.9 billion monthly-average-users engaged within the company’s app ecosystem, Facebook has also been investing in smaller projects that portend a launch into the metaverse. Oculus, the virtual reality headset, is the most high-profile example. Of at least equal importance, however, are Diem- the company’s blockchain-based payment system- and Novi- the accompanying digital wallet. When paired with the immensely popular Facebook Marketplace, the company has laid a foundation for a crucial aspect of the metaverse: a fully functioning economy where virtual and physical world wealth eventually merge.

While cryptocurrency has been the obvious example of this convergence for the past decade, we have more recently seen very enthusiastic mainstream adoption of non-fungible tokens (NFTs). Although much of this is undoubtedly brazen speculation, significant amounts of real dollar value are being placed on digital goods. Unlike many pieces of expensive physical art, NFT owners are proud to display their six figure JPEGs as social media profile pictures: Jay-Z's Twitter picture is a $126,000 CryptoPunk.

In their current iteration, NFTs mostly convey social status, though some such as the Bored Ape Yacht Club offer members (NFT owners) perks and exclusive access to digital spaces- a sort of precursor to the metaverse. Eventually, virtual real estate, property, goods, businesses, contracts, etc. will be structured as NFTs to ensure their validity and scarcity, giving them value. This means that as people’s lives become more and more digitized, the utility of NFTs will only grow. Buying and selling these digital assets will be done much like it is in the real world- in peer-to-peer transactions or via marketplaces.

Facebook has the metaverse interest, underlying infrastructure in Diem and Novi, and experience in marketplace construction. However, it does not currently have a real means to exchange NFTs on any of its platforms (there are many Facebook groups for NFT sales, but these direct to third party sites). Building an exchange from the ground up would be difficult and expensive for technical reasons as well as from a customer acquisition angle. Why compete against a business model that has inherent network effects when it can just be bought? Why not dust off the successful Instagram and WhatsApp playbook and go out and buy an already functioning NFT marketplace? Why not buy OpenSea?

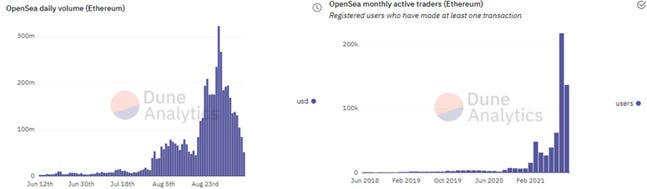

OpenSea.io is an exchange that was started in 2017 and has quickly risen to be the top marketplace for NFTs with over $3.4 billion in volume in August alone- 10 times the amount seen in July. OpeaSea charges a 2.5% transaction fee which implies August revenues of approximately $85 million. On August 29th, $322 million in value crossed the platform- with OpenSea booking over $8 million of revenue in a single day.

Source: Dune Analytics

Given OpenSea’s stunning rate of growth and (speculated) profitability, Facebook would have to pay a nosebleed multiple for the company, especially considering major VC backer Andreessen Horowitz is unlikely to allow the platform to be sold for anything remotely resembling a bargain1. Between $16 billion in cash, $48 billion in “marketable securities”, no debt, and a stock price at an all-time high, the company has ample resources to fund a bid. All that said, the synergies would be incredible. Facebook would have an operating (though, at this time, narrow in scope), cash-flowing metaverse marketplace that could eventually run on the Diem rails, have assets stored in the Novi wallet, and be experienced through Oculus technology. More immediately, NFT buyers and sellers would be plugged into the world’s largest social network allowing them to seamlessly advertise, promote, or simply show off their wares on Instagram, the Blue App, and WhatsApp.

Assuming some tie up like this is not already in the works, tech bankers ought to be banging down Facebook’s door pitching this deal. The coming metaverse economy built on Facebook infrastructure is as exciting and terrifying for the world as it is lucrative for those who financially engineer it.

Andreessen Horowitz was a seed investor in Instagram, which sold to Facebook in 2012 for $1 billion- a price many initially considered excessive as the company at the time had no revenue. It has since been regarded as one of the greatest purchases ever with Instagram’s value estimated at around $100 billion today. Do not feel too badly for Andreessen Horowitz: their $250,000 investment returned $80 million, good enough for a 31,900% gain.