Stride Inc. (LRN): We Are Not Another DeVry

Before there was Zoom High School, there was Stride

Thesis

Stride, Inc. (formerly K12 Inc.) has been mischaracterized as just another for profit educational company with dubious tangible outcomes for graduates and a proclivity for attracting front page regulatory scrutiny. In reality, the Company mostly operates outside of the controversial post-secondary education market and has a popular core product that experienced widespread adoption and legitimization tailwinds due to the COVID-19 pandemic. Through organic efforts and a series of acquisitions, Stride is pursuing an aggressive growth strategy into high margin professional skill development and certification. The reinvigorated core businesses, already promising explosive growth seen in the professional skills initiative, competent and invested management, and a surprisingly attractive, low-multiple price make Stride a compelling buy.

Background and Company Description

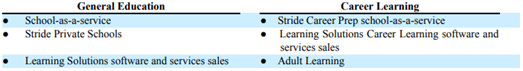

Stride, Inc. (NYSE: LRN, the Company) is an education services company that offers instruction, curriculum, materials, digital tools, and a learning management system (LMS) for virtual and blended schools. Historically, the Company’s General Education business was centered around “School as a Service” for virtual public charter schools. In a typical arrangement, Stride would sign a non-binding contract (usually with a duration of five years) with a public charter school board to provide its end-to-end remote educational services and, in turn, receive public funding (tax dollars) tied to the total number of students enrolled. Although the board is entirely independent and reports to the state or school district, Stride effectively manages all aspects of the school from the instruction to the provision of physical materials (books, personal computers) to the technology backbone to administrative and academic support systems.

In the past five years, Stride launched its Career Learning product and began offering professional skills courses alongside the standard General Education curriculum. These classes were created to prepare middle and high school students for talent-hungry, fast-growing industries such as IT and healthcare. More recently, the Company entered the post-secondary education career development market with the acquisitions of Galvanize (January 2020, data science), Tech Elevator (November 2020, software engineering), and MedCerts (November 2020, healthcare training).

Most of Stride’s revenue and corresponding focus is on the platform “School as a Service” model, though the Company, through its Learning Solutions arm, does sell unbundled, à la carte versions of its General Education and Career Learning products to schools that may be looking to augment their existing curriculum. Other, smaller services include a DTC business for K-8 materials and management of three accredited, private, tuition-funded virtual schools that primarily target overseas students who are seeking an American education.

For-Profit College Misconceptions and Stigma

For years, Stride has been incorrectly categorized as just another for-profit educational institution that is one federal law change or disgruntled alumni lawsuit away from implosion. Former CEO and current Chairman, Nathan Davis, describes the issue:

“We are not a for-profit college. It's hard because there are no other public K-12 general education companies out there. So, we get lumped in with the for-profit colleges, but… we don't provide the same kind of funding, we're not in the same kind of loan situations that they are in. We provide a service to the public pool districts. And as such, for them (the federal government) to go after our business, they'd have to go after public school districts.”

FY Q2 2021 earnings call

Davis makes a crucial distinction: unlike for-profit colleges that rely on federal student loan monies, the bulk of Stride’s revenue comes from agreements with school districts- which ultimately receive their funding from the state. This has the dual benefit of avoiding any contentious matters surrounding onerous student debt and greatly increases the count of sources of income (i.e., multiple states and districts as opposed to the monolithic Department of Education student loan entity). While this structure absolutely does not immunize Stride from regulatory risk, school districts and boards are a fragmented, heterogenous interest group that are insulated from drastic, sweeping federal mandates (management also hints that many boards like to demonstrate their autonomy and not blindly follow federal suggestions and guidelines) that could immediately jeopardize a for-profit college’s entire business.

Target Market and COVID-19 Impact

Stride explicitly acknowledges that its virtual General Education and Career Learning solutions are designed for a specific subset of students who, for one reason or another, have difficulty in a traditional school environment. These reasons can include a desire for a different style or pace of instruction, physical disabilities, health, safety, or social concerns, geographic and scheduling flexibility (common with expats and frequently relocating military families), etc. Management believes this cohort (which overlaps with the estimated 2.5M homeschooled children in the U.S.), though small relative to the overall U.S. student population, is still underserved and represents a $35B TAM in General Education and a further $65B in Career Learning.

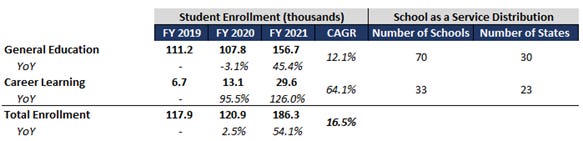

Unsurprisingly, the COVID-19 related shutdowns and mass transition to remote learning were incredible boons to Stride. In the 2020-2021 school year, the Company’s General Education enrollment jumped 45% to 156,700 students, Career Learning more than doubled to 29,600, and both areas have shown high retention rates despite the country mostly reopening in Spring 2021. Management will not release data or forecasts for the 2021-2022 school year until Q1 earnings in October, but their comments suggest that the Delta variant has been a considerable driver of (re)enrollment:

“The enrollment trends, pre-registration trends are very strong, we're seeing more than we've ever seen… a lot of the states that have spikes in Delta variant, places like Texas, we just see sort of unprecedented demand, very similar to what we actually saw last year. So, we see that spike happening now. We think that a lot of people are going to have ongoing concerns about safety, and we think it bodes well for the long-term prospects for our business…”

James Rhyu, CEO, Q4 2021 earnings call

Despite mixed (at best) results, COVID-19 has normalized the concept of virtual learning and may prove sticky in expanding the availability of hybrid programs. In April 2021 one third of high school students surveyed wanted some remote educational component post-pandemic. Stride conducted a separate poll around this period that revealed 10% of families were considering a fully online high school option (up from two to three percent the year prior), Again, Stride’s target market is not the entirety of the K-12 student body, but the Company could pick up some additional customers (including some of the estimated 15% of students who fell behind and need extra help or otherwise “went missing” from the system due to the shutdowns) who first experienced virtual education during the COVID-19 era.

A more important and consequential effect of the pandemic, however, is how regulators react to the increasingly legitimized and popularized virtual learning segment. Stride notes that many laws today, such as attendance and check in requirements or geographic restrictions, are clearly geared towards traditional, in person education and have little relevance to the remote setting. With virtual learning in the public eye, regulators may be incentivized to update rules that are more congruent with modern technological mediums, loosen enrollment restrictions, and expand or remove current funding caps- all allowing for easier and faster growth of Stride’s General Education business and the remote schooling industry broadly.

Growth Through Career Learning

In December 2020, the Company changed its name from K12 to Stride to reflect the growing importance of its professional skill development services. Since FY 2019 the Career Learning product has seen revenues 5x to $256.6M (73% CAGR) and enrollment increase by nearly the same multiple to 29,600 students. Customers fall into one of two buckets: K-12 and adult. In K-12, Career Learning has been shown to boost retention rates by 5% when compared with schools than only offer General Education and provides means of expanding the core “School as a Service” offering without relying on favorable regulatory developments.

The adult bucket- consisting of Stride’s recent Galvanize, MedCerts, and Tech Elevator acquisitions- has been the primary driver of growth and its higher margin structure has been pulling the Company’s overall gross margin upwards, ahead of schedule, toward the FY 2025 target of 36-39%. These businesses position the Company to benefit from secular trends such as greater interest and uptake in non-degree post-secondary education- effectively vocational curricula that grant graduates certifications and licenses that are directly applicable to specific jobs. The BLS estimates that these types of certification-linked roles will grow at twice the rate of overall employment through 2029.

Faced with new hires that need specialized training or unwilling to bear the expense of replacing an existing workforce whose skills do not match the future needs of the business; many corporations have been managing internal educational programs. Stride has begun working with these companies to build customized digital courses as well as plugging its own brands into the recruiting pipeline. For example, MedCerts has partnered with Equus Workforce Solutions (a staffing and training agency) to provide apprenticeship opportunities for those enrolled.

All this is to illustrate that Stride is quickly becoming a cultivator and aggregator of in-demand talent. Revenues for this business come from individuals (tuition) or private companies and do not carry the public funding regulatory risk inherent to the General Education segment. Without the implicit threat of taxpayer blowback (justified or not), value creation through operational leverage (tech investment) can be captured by the Company instead of passed through to customers- increasing profitability.

Nathan Davis again:

“We wanted the market to understand that we're now more than a charter school business that has all the regulatory risk. We're no longer that kindergarten to 12th grade charter school operator chasing the $11 billion market. We've strategically grown and positioned ourselves as an industry-leading education, technology and services provider, serving students of all ages in an addressable market, valued in excess of $100 billion.”

Going Private?

Many of the competitors listed in Stride’s filings have gone private in recent years in strategic or financial buyouts. A key advantage of being a private for-profit educational provider is the absence of disclosure around financials, specifically margin improvements. This is discussed above and in the Risks section, but suffice to say private status removes an undefined, yet very real profitability constraint.

The thesis absolutely does not rely on Stride removing itself from the public markets and there have been no hints of the Company wanting to go private (particularly given its recent acquisitions in the adult education area). However, it represents an interesting, if far-fetched, option.

Valuation

Trading at 1x sales and 5.8x forward EBITDA, Stride is attractively priced when accounting for growth prospects and even today on a comparable basis.

Revenue growth at 7% CAGR, arriving at midpoint of management guidance of $2.05B in FY 2025

$800M of revenue from Career Learning vertical

Gross margins at upper range of targeted 36-39% (currently at 35%, increasing with Career Learning revenue contribution growth)

$260M operating profit, 12.5% margin in 2025. Midpoint of management $250-$350M guidance “adjusted operating profit” after subtracting the excluded (“adj.”) projected stock-based compensation.

FCF (EBITDA less Capex at 7% of sales) of $311M, margin of 15%, FCF conversion of 76%

15% WACC

As discussed above, lack of exact comparables necessitates including for-profit colleges as well as other digital education platforms

Risks

Regulation: Stride is quite obviously subject to multiple layers of regulatory risk. However, its established track record and experience working with regulators, the fractured nature of educational governing agencies (state and school districts), greater understanding and adoption of virtual learning due to the pandemic, and a shift toward professional development that carries less government oversight all bolster Stride’s resilience in the face of unexpected adverse regulatory events.

Public company that accepts public funds: Being a for-profit company that relies heavily on taxpayer dollars has two main headline risk downsides. The first is that everything is in the public domain and will inevitably be referenced in instances of litigation or publicized discontent. The second derives from the first in that because financial information is readily available, margin improvements (whether the result of price hikes or cost reductions) that are not passed through to the taxpaying customer may be construed as profiteering from children’s education- an indefensible PR nightmare. Stride understands this and consequentially is pushing profitability (gross margin growth) through its adult Career Learning segment.

Pandemic popularization of virtual school proves fleeting: Enrollment headcount drops, and the Company’s General Education vertical suffers before its Career Learning offering can grow to sufficient scale. Preliminary indicators show the opposite is true- remote education interest has grown.

Deep pocketed competition: Adult Career Learning demand declines as large companies offer their own certification and training programs. Google already provides a “Career Certificates” course through Coursera. Many of these programs, including Google’s, tend to be shorter, less expensive, and not as rigorous as Stride’s MedCerts, Tech Elevator, and Galvanize. They also leave graduates with little more than basic working knowledge of professional field and a certificate to display on LinkedIn. In contrast, Stride’s courses usually include some hands-on experience and connection to an industry (e.g., as with MedCerts’ apprenticeship).

There are plenty of other firms of varying quality that sell similar non-degree post-secondary programs. That said, this space is massive and there is ample room for multiple winners.

Catalysts

Career Learning optimization and expansion

Fully integrate and benefit from MedCerts and Tech Elevator acquisitions

Finish restructuring of troubled Galvanize business

Increase uptake of Career Learning products across middle and high school, adult, and corporate customer segments

Additional accretive acquisitions

Q1 2022 (October 2021) earnings with enrollment figures

Realizing suspected benefit from Delta variant concerns

Pandemic induced stickiness for virtual learning

Another instance of COVID-19 as the “great accelerator” (of remote learning)

Market understanding that Stride operates in a unique segment that outside of the high risk, public relations disaster realm that is for-profit colleges.

Q1 2022 Update (quarter ended 9/30/2021)

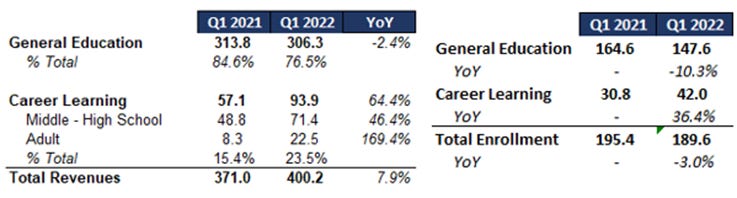

Even with re-openings and the rise and fall in Delta variant related COVID cases, Stride managed to post strong General Education re-enrollment figures with 147.6K students. Though this is lower than last year’s 164.6K COVID-fueled figure, management sees current enrollment as a new, higher baseline than pre-pandemic. Curiosity in Stride’s virtual school offering is at an all-time high with 1M unique monthly visitors to the Company’s website. Management cites high conversion rates thanks to (pandemic induced) familiarity with remote learning, though numbers are not disclosed.

Stride noted the effects of the national teacher shortage- including having to reduce enrollment in certain states due to lack of educators. Even pre-pandemic, teachers were in short supply with COVID exacerbating the issue. The Company is in a unique position with a decided competitive advantage over even the most prestigious brick and mortar schools whereby they can guarantee teachers the flexibility and safety of remote work. However, there are regulatory barriers that can restrict educators to practice only in the state(s) in which they are certified.

Highlights and Guidance:

Adult Career Learning targeting $100M revenue in FY 2022

Increase in revenue per enrollment

General Education: 9.7% YoY

Career Learning- middle & high school: 8.0% YoY

Q2 2022 guidance for $390-$400M of revenue