Xometry (XMTR): Machine Learning Meets Machine Cutting

A different kind of market maker that is not being grilled by Congress

Summary

Xometry is strongly positioned to capitalize on the custom manufacturing market’s shift to digital.

By adopting a tech-centric, market maker model, Xometry can quickly scale without requiring the huge sums of capital typically associated with manufacturing.

The Company recently went public and is facing an inflection point of exponential growth driven by its core marketplace, international expansion, and nascent, but promising financial services.

Thesis

Xometry’s asset light, tech-first, market maker, two-sided network effect model enables the Company to quickly scale and affords an exceptional competitive advantage amongst marketplace-provider peers and legacy brokers within the increasingly digitizing on-demand manufacturing sector. Healthy core customer and revenue growth, ample expansion opportunities through international markets and ancillary services, combined with macro tailwinds such as tech adoption among SMBs, manufacturers’ interest in fortifying supply chains by localizing input products, and a general desire for a less opaque, more efficient marketplace system make Xometry a long term, growth-story buy.

Background and Company Description

Xometry (“the Company”, NASDAQ: XMTR) is an AI-driven marketplace that matches buyers and third-party sellers for custom, on-demand manufacturing. The main services offered are CNC and sheet metal manufacturing, 3D printing, injection molding, die and urethane casting. Buyers upload schematics, specifications, tolerances, and other production requirements to the platform. The Xometry pricing engine analyzes the requested components, factors in the complexity of the task, order size, location, materials, lead time, etc. and delivers an instant quote to the Buyer. Parts that are too complicated or unrecognized by the software are submitted for human review (anecdotally, this tends to occur more frequently with multi-piece or multi-material products).

Once the buyer accepts, Xometry commits to supplying the component at the quoted price and matches the order with a seller that is registered on the platform. Xometry sits between the buyer and seller, assuming all price and product quality risk. That is, if the price quoted to the buyer is lower than the ultimate clearing price to a seller or the component does not meet the stated specifications, Xometry bears the loss and responsibility.

(Xometry S-1)

Substantially all the Company’s revenue is derived from capturing the delta between prices paid by the buyer for a component and cost of sourcing the item from sellers. Geographically, the United States accounts for over 90% of sales with the remainder coming from Europe. As of June 30th, 2021, the platform has nearly 24,000 active buyers and 1,400 active sellers (active defined as having made, at minimum, one purchase or sale in the trailing 12 months). 30% of Fortune 500 companies have transacted on the platform. 95% of revenues were generated from existing accounts (each of which may have more than one buyer), indicating a high degree of customer stickiness, though a weak form (non-contractual or standardized frequency) of recurring revenue.

Xometry stylizes itself as operating in the $260B custom on-demand manufacturing space which remains highly fragmented and, like other markets including autos, payments, and short-term rentals, well positioned for transparency and reduced friction via digitization.

(Xometry Q2 2021 Investor Presentation)

The On Demand Goods Market

Inefficient, Frustrating, and Ripe for Disruption

In contrast to most other areas of the economy, the manufacturing industry remains largely analog and has seen a tepid, at best, uptake of digitization. Outside of several massive, multinational producers, the sector is comprised of an estimated 625,000 SMBs, sole operators, and mom and pop stores. These smaller shops lack the scale, resources, supply chains, and geographic reach of the larger producers. Managing the day-to-day business- which often involves close oversight of expensive and complicated machinery- coupled with thin profit margins, leaves owners with little time or financial cushion for updating and digitizing sales and marketing processes. Xometry aims to do for its sellers what Etsy has done for crafts merchants and what Angie’s List has done for home services: aggregate buyers while providing a streamlined, digitally integrated sales and distribution platform that allows producers to focus on their core competency of manufacturing specialty components.

Because of the lack of standardization or available industry guidance, buyers of machined parts face a byzantine due diligence and price comparison maze when selecting a manufacturer. Sourcing even a simple custom component with looser tolerances, irrespective of order size, becomes a back and forth, highly manual, time consuming, and draining endeavor that inevitably detracts from other areas of both the buyers’ and sellers’ businesses. Even after finding a producer and agreeing to terms, buyers must wait for the component to be machined and shipped. Sellers report frequent late payments or onerous terms (e.g., net 120 from larger buyers with market power), risking cash crunches or even insolvency. Xometry uses AI and matching algorithms to internalize this entire series, consolidating it to, sometimes literally, a single click.

COVID-19 has laid bare the fragility of the concentrated, global, just-in-time supply chain construct. While buyers had been diversifying their set of suppliers prior to the pandemic (notably due to tariffs associated with the U.S.-China trade war), as goes the cliché, COVID-19 has accelerated this trend toward seeking more resilient sources of input goods. Any tool that would allow access to more suppliers, particularly local ones, would do much to fortify a company against further supply chain shocks.

Xometry’s Advantage in Manufacturing’s Digitization

The Company is uniquely positioned to benefit from manufacturing’s sorely needed and inevitable move to a digital ecosystem.

1. Asset Light

While being “asset light” without extreme capital or infrastructure requirements is not always an advantage (asset heavy industries have a high barrier to entry, offering incumbents an inherent moat), it confers a distinct advantage when trying to create a market consisting exclusively of asset intensive participants. Unlike competitors, such as Proto Labs, that run all their manufacturing services in house, Xometry is more akin to a smart, AI-enabled market maker that connects buyers to existing, third party production facilities. Rather than spend enormous sums building out physical machining shops, the Company can dedicate resources toward developing their technology stack.

The tech foundation also allows for SaaS-like high operating leverage and quick scalability as adding production capabilities is a matter of onboarding suppliers- not pouring concrete, purchasing intricate presses and 3D printers, and hiring the staff required to use these machines. In Q2 2021, Xometry successfully used this asset light, bolt on approach to add 60 new “processes, materials, and finishes.” The Company’s value proposition undoubtedly becomes even more attractive and sticky if it can serve as a one stop shop for a wider variety of manufacturing needs.

2. Two Factor Flywheel

At first glance, Xometry has the typical two-sided network flywheel: more buyers on the platform creates greater demand for sellers’ services. As more sellers join the marketplace, the number of service options increase, attracting more buyers, and growth accelerates.

(Future Blind)

However, the company has a second factor driving the flywheel. As more buyers and sellers join, they contribute more data to Xometry’s AI and machine learning pricing and procurement algorithms- improving the programs’ accuracy, attracting buyers and so on. Because the Company takes price risk, technology that enables Xometry to capture the largest, positive spread between the buyer’s price paid and seller’s invoice goes straight to the bottom line and boosts margins. Well trained algorithms combined with a massive trove of proprietary data further widens the Company’s defensible moat.

(Future Blind)

3. Global Reach Without Supplier Power

One means of segregating marketplace creators is by determining if their platform is “local” or “global” (or non-local, i.e., regional, national, etc.). Local is characterized by physical services that must be performed at the customer’s location (house cleaning, an Uber ride) or is a non-transferrable, perishable good or experience (meal at a restaurant, in person live entertainment). Having a monopoly within a local market is obviously ideal for the platform provider. The provider can charge higher fees and the exclusivity allows for greater leverage over suppliers- even over those who might have a differentiated offering. The tradeoff is that capturing a local market is an expensive slog, fraught with regulatory challenges and outright animosity. Uber’s countless fights with local taxi commissions is the classic example.

Global markets deal in transportable goods and remote services. Thanks to the internet and third-party logistics as well as technology infrastructure providers, geographical location has become a non-issue for many buyers and sellers of a certain type of product. Marketplace creators enjoy the incredible operating leverage and ease of scaling afforded by having a global base. However, there is an underlying risk that a seller, delivering on a global scale, might be able to make use of the same “LaaS” (logistics as a service) and sell direct to consumers via its own storefront- cutting out the marketplace creator entirely. Alternatively, the seller might remain on the platform but use the threat of DTC defection to extract concessions from the marketplace provider. Thus, the creator is subject to the hazards of supplier “star power.”

Xometry avoids the pitfalls of both the global and local structures while capturing much of their upside. Because buyers and sellers are dispersed and the goods sold on the platform are easily transportable, the Company does not have the issue of fighting city by city, lighting cash on fire to simultaneously attract supply and demand to build a marketplace on a local level. Thanks to Xometry’s market maker approach whereby it is the only buyer and seller, “star power” risk is minimized as sellers are anonymized: there is no accumulated brand equity that sellers could build up, transfer to another marketplace or their own storefront, and lure buyers.

However, Xometry’s management understands that having a local base of sellers in addition to international options is important to their expansion efforts, and the Company is currently focusing on enlisting manufacturers in the European market (particularly in Germany). Again, part of the value proposition is localized, resilient supply chains with shorter times to delivery- suppliers cannot be exclusively overseas.

Other Drivers of Growth

Outside of the core, domestic marketplace, Xometry has two other promising growth vectors:

1. Seller services

Xometry has two main groups of ancillary offerings it labels “Seller Services”:

Xometry Supplies: connects sellers with favorably priced suppliers for input goods, materials, and tools. The Company channels the data generated from these transactions into its algorithms to predict which sellers have the requisite resources for a particular job and match them accordingly.

Financial Products and Services: released in mid-2020, offerings include: Xometry Advance Card (30% of job payment in advance, alleviates working capital issues), FastPay (full job payment less a fee within three days of completion), and Digital Storefronts (sellers can sell directly to customers on the Xometry platform and the Company charges for financial services as well as automated invoicing, payouts, and customer credit limit setting tools). Storefronts are less than a year old and their direction and overall business impact is still very uncertain: will sellers stop selling to Xometry at the algorithmically determined price and instead go directly to the customer, using the platform as the financial infrastructure?

As of the end of 2020, only 40% of active sellers had used at least one of these services and the Company states that the “offerings (have) not been a material driver of our overall revenue to date.” That said, service revenue is expected to grow, especially considering that the financial products can be used for jobs outside of the Xometry core marketplace. The archetypal Xometry seller is a small, cash poor, asset heavy, single location operation with limited bank financing options and weak negotiating power with giant commodity suppliers. If the Company can successfully improve a seller’s margins (by lowering input costs and corresponding COGS) and deliver a comprehensive suite of financial products, the Xometry ecosystem becomes even more compelling and sticky beyond simple network effects.

2. International expansion

As mentioned earlier, the United States accounts for 90% plus of all sales, with Europe comprising the remainder. The Company acquired a Munich based team in mid-2019 to launch its European offering. Since then, the region’s revenue growth has been explosive with $3.3M in Q2 2021 sales (implying a ARR of ~$13M) alone surpassing the entirety of 2020’s $3.1M (ARR YoY of over 300%), though the absolute figure remains insignificant compared to the United States’ Q2 2021 of $47.2M.

Xometry plans to expand to the Asia Pacific market by Q1 2022. The Company already has a small number of sellers in the region and believes it can use lessons learned from its European expansion to accelerate the Asia Pacific rollout. Xometry’s AI pricing technology- its secret sauce and basis of its competitive advantage- provides the high-octane operating leverage as it is mostly fungible and can be easily deployed to these foreign markets.

Valuation

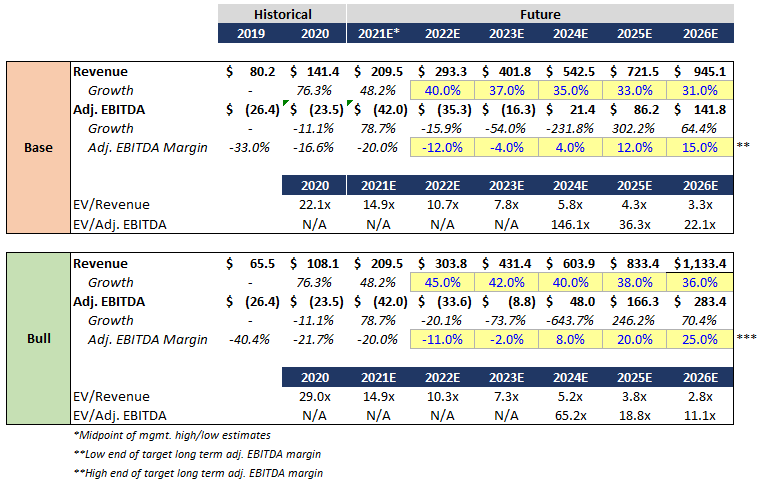

This a firm with SaaS-like exponential scalability, growing at 92% CAGR between 2018 to 2020, entering a huge and (digitally) untapped market: predictability beyond a quarter or two is near impossible. The following is a very basic valuation scenario:

Revenue growth is set to decline at a linear pace until the end of the prediction period at EoY 2026. This is a highly conservative estimate given the potential for accelerated growth by way of operational leverage, international market rollouts, and ancillary services.

EBITDA margins represent management’s stated long-term goal of between 15% and 20%.

Comparables for EV/revenue multiples are selected on the basis that they represent some feature of Xometry: digital marketplace, disruptive technology, market maker business model, and financial services.

Bull (Base)

6.1x (5.3x) 2026E revenue implies an EoY EV of $6,926.4M ($4,973.7M)

Discounted back at 10% (approximate annual stock market return, certainly an aggressive rate given company is unproven), implied premium to current EV is 51.1% (8.5%)

Moving from EV to equity value, the implied price per share is $103.4 ($73.4), a 53.5% (8.9%) premium to the market value.

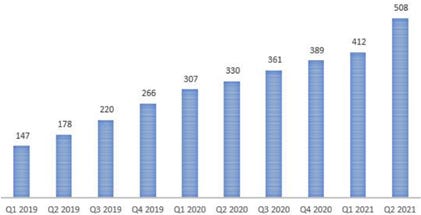

As a note, an alternative means of determining value could involve looking at growth in active buyers, especially those with last 12 months spend of at least $50,000 (this threshold seems to be management’s preferred gauge for how likely a customer is to continue using the platform). However, this has several shortfalls including only looking at one side of the market (ignoring revenue from sellers purchasing services), lack of public data around CAC or LTV (only the LTV/CAC ratio is disclosed), usefulness of historical growth rate for a company that may be at a massive inflection point, and the non-linear relationship between number of buyers and company financial performance (again, a feature of high operating leverage), among other issues.

(Xometry S-1)

Accounts with Last 12 Months Spend of at Least $50,000

(Xometry 2021 Q2 10-Q)

Risks

A Non-Exhaustive List

Better mouse trap: Xometry’s success is entirely dependent on it having best in class AI and machine learning technologies to both increase transaction volume on its platform and charge prices at which it can still make a profit

Entry of larger competitors: while the Company’s technology offers a legitimate moat, there always exists some chance that a well-capitalized firm enters the space

No direct quality control: Xometry matches buyers and sellers and does not have direct input into the production quality of the seller. Buyers will blame Xometry for any unsatisfactory components and likely leave the platform. The Company must constantly vet sellers to ensure minimum standards.

International expansion: launching in new markets, especially those with different business cultures and norms, is very difficult and fraught with regulatory and operational risks

This is a growth story: the Company was founded in 2013 and went public in early 2021. Profitability is a distant target. Much remains unknown about the trajectory of the firm and the direction of the on-demand manufacturing sector broadly.

Catalysts

Continued supply chain disruptions pushing firms to adopt new component sourcing methods

International expansion

Increased usage and roll out of ancillary services

Longer term, highly uncertain:

Infrastructure Bill as a potential boon to demand (expect more color in Q3)

Added value from existing and new partnerships (SOLIDWORKS, Autodesk Fusion 360)