Summary

Aeroméxico’s imminent emergence from bankruptcy will likely spur a liquidity event and stock price rerate with potential 50% upside for Canadian holdco Aimia

The bankruptcy plan of reorganization hearing is set for January 27th at which point the final consideration and timing of the liquidity event will become more certain

Company Background

Aimia Inc. (TSX: AIM.TO, OTC:AIMFF, the Company) is a Toronto based holding company that has historically invested in loyalty services companies, otherwise known as frequent flyer programs. In early 2020, Aimia purchased Chris Mittleman’s “deep value” (low multiple, proverbial cigar-butt targets) asset management firm and announced a shift away from specialized loyalty services toward a more generalized investment strategy. Chris Mittleman was appointed CIO and his brother, Phil Mittleman, assumed the CEO role.

The Opportunity

Aimia’s largest asset is a 48.9% stake in Premier Loyalty & Marketing (PLM)- the loyalty program for airline Grupo Aeroméxico. Aeroméxico owns the remaining 51.1%. The airline has been in on and off discussions with Aimia since 2018 regarding purchasing the minority stake. In Q1 2020, the two parties signed an LOI to negotiate a sale of PLM at 7.5x adjusted EBITDA with a floor price of $400M USD. Shortly after, however, Aeroméxico filed for Chapter 11 bankruptcy in the wake of the COVID-19 driven drop in passenger traffic and corresponding revenues.

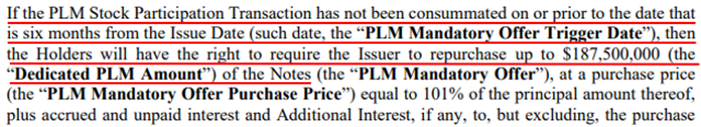

After a year and half of negotiations, Aeroméxico is set to confirm a Plan of Reorganization (PoR) on approximately January 27th. The PoR carves out $375M USD ($472.5M CAD) in the “PLM Stock Participation Transaction” for the acquisition of Aimia’s PLM holding.

When accounting for Aimia’s share of PLM’s excess balance sheet cash and the loyalty program’s expected normal cash distribution, pre-tax proceeds amount to approximately $531.4M CAD.

Assuming the PoR is accepted, PLM is sold in line with the above consideration, Aimia’s sum-of-the-parts valuation implies up to a 50% upside from the current share price.

This Time is Different

As previously noted, both Aeroméxico and Aimia have been trying- with varying degrees of seriousness- to complete this deal for the past several years. Right now, there is an overwhelming permissive context with specific, acute catalysts galvanizing a close:

Aeroméxico

PLM Mandatory Offer: $187.5M USD, or half, of the proposed $375M USD for the PLM acquisition is in the form of first lien notes. These notes must be used to fund the PLM buyout within six months of issuance. If the transaction has not been “consummated” with the six months, Aeroméxico must repurchase the notes at 101% of face (plus accrued). These onerous, not uncertain terms give Aeroméxico a clear incentive to execute the deal and the creditors’ keen interest in bringing PLM entirely in house.

Value of Wholly Owned Loyalty Programs: airlines have come to rely on their loyalty programs as a means of high margin, relatively stable cashflow that helps them retain customers in an otherwise commodity industry. The economics are well laid out here. Suffice to say that in many instances, the actual operations of an airline (flying passengers) are subsidized by these programs. Their value is crucial to the financial health and prosperity of an airline. Over the past several years, many airlines have been scrambling to reacquire programs they either sold or mortgaged in the past.

Aimia

Executive compensation: Aimia’s President as well as both Mittleman brothers will be collectively awarded 2.55M deferred share units if the share price (VWAP) exceeds $6.00 CAD for 20 consecutive trading days. Closing the PLM deal would likely force the rerate and be a personal windfall for these top brass.

Trend away from loyalty services investments: The 2020 Mittleman acquisition was a deliberate decision by Aimia to become a generalist investment holding company. The firm has been divesting from loyalty assets since the end of 2018 with the sale of Air Canada’s Aeroplan loyalty program (Aimia Canada) and the more recent exchange of Aimia’s BigLife stake for common shares in the asset’s partner airline, AirAsia Berhad. PLM is the next asset on the chopping block.

Messaging: Through explicit press releases as well as more subtle changes in the Company’s description of itself, Aimia has been strongly signaling its intention to sell PLM.

The deal closes, now what?

Aimia is debt-free and would likely use a substantial portion of the transaction proceeds to repurchase shares under its existing Normal Course Issuer Bid (NCIB). This is a buyback initiative typical of TSX listed companies whereby the exchange must preapprove any repurchase programs. Under its current bid, Aimia has permission to repurchase up to 7,349,628 shares (~8.1% of diluted shares outstanding) through June 2022.

Additional uses of capital could include the Company lobbying the exchange for an increase in the size of the NCIB, a special dividend, or further investments as deemed appropriate by the Mittleman team.

Risks

This is a special situation Canadian microcap stock hinging on a sale of asset to a company emerging from Chapter 11 bankruptcy. The situation is, of course, highly fluid and uncertain.

Creditor objections to the PoR: A prominent creditor, Invictus Global Management wrote an open letter to Delta Airlines (a minority equity holder that has negotiated for favorable entry terms into Apollo’s DIP tranche). The details of the objection are unimportant, rather Invictus may delay or obfuscate the PoR hearing and implementation- perhaps even negatively impacting the PLM acquisition terms

Aimia insists on Aeroméxico adhering to the previously negotiated LOI for $400M USD or 7.5x adjusted EBITDA. This is unlikely.

Disputes over PLM loans to Aeroméxico: Aimia and PLM filed objections to the PoR on January 11th citing $65M in loans PLM made to Aeroméxico during the COVID downturn. If the PoR were to be enacted as written, these loans would be written down to zero. This is non-trivial, but otherwise not expected to scuttle the deal.

Omicron variable: Much of the PoR and backchannel discussions between Aimia and Aeroméxico were conducted prior to the emergence of the COVID-19 Omicron variant. While this is not expected to disrupt the long term fundamental case for the sale of PLM, its rapid spread and yet to be determined effects on air travel may cause Aeroméxico to postpone the PLM deal.

Thanks for sharing this write-up. I have held Aimia in the past, and there are a couple of points I would question in the valuation.

1. Why is corporate overhead only capitalised at 5x?

2. Do you not feel an investment holding company discount is appropriate? e.g. look at PSH discount.